On July 3, 2023, the land assessment standard values for fiscal year 2023, the basis for calculating inheritance and gift taxes, were announced.

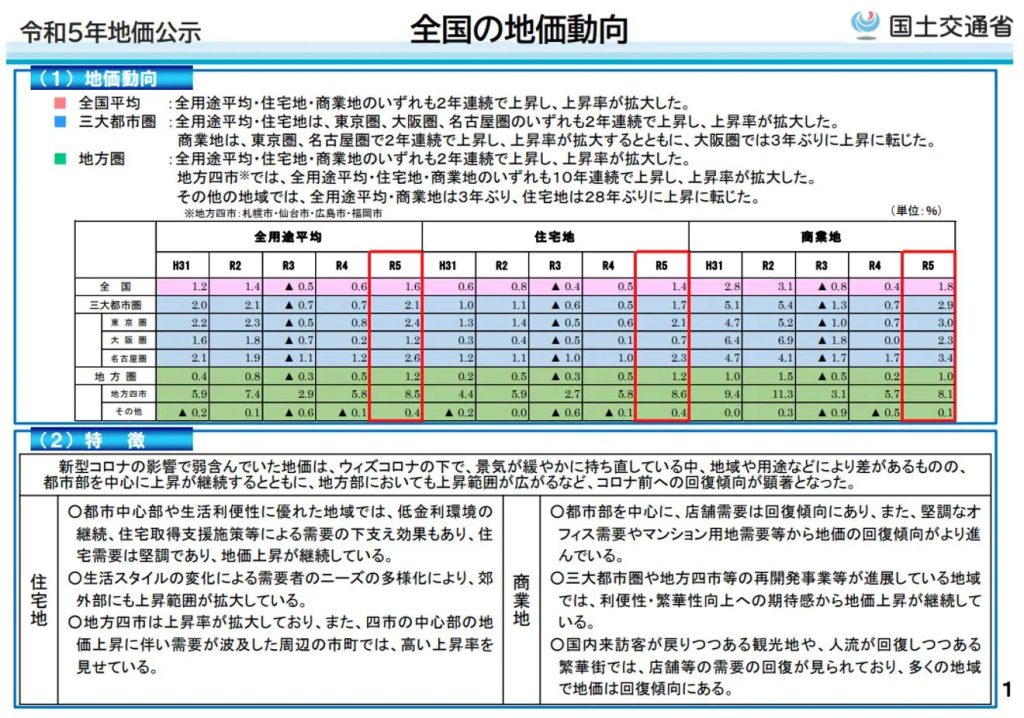

As for the results, the national average of the standard residential land price increased for the second year in a row, with an average of approximately 1.5%.

The declared value, which is released earlier than the “roadside land prices,” also showed a positive rate of change for all purposes, the results are roughly in line with the given expectations.

In the official list of declared values, commercial land, which had been weaker due to the impact of corna virus, increased from 15 prefectures in FY2022 to 23 for FY2023.

Although it had been predicted that roadside land prices would rise in FY2023 due to such an increase in declared values, the highest roadside land prices rose in as many as 29 cities. This trend has been analyzed as a result of the normalization of socioeconomic activities by companies, including an increase in inbound demand which has been stimulated by the calming of the pandemic.

However, it is pointed out that there are differences in the recovery trend in areas where office demand continues to be sluggish, with prices remaining flat at best, and rising only slightly at best.

With that being said, we would like to focus on trends in roadside land prices for this blog.

Roadside Land Prices: Basics

The official declared values is one of the most important indicators of land prices. The Land Appraisal Committee of the Ministry of Land, Infrastructure, Transport and Tourism examines approximately 26,000 reference sites nationwide as of January 1 of each year with the cooperation of real estate appraisers to determine an appropriate price per square meter.

Unless special circumstances exist, it is close to the prevailing price, and we are recommended to use it as a reference when conducting our own assessments. However, as you may know, the market value fluctuates depending on various factors, thus the official declared values do not always equal the market values.

While the declared value is under the jurisdiction of the Ministry of Land, Infrastructure, Transport and Tourism, the National Tax Agency has jurisdiction over roadside land prices, which are property valuation standards used as the basis for calculating inheritance tax and standard land prices.

While the official declared values are used as the basis for real estate appraisals, and for calculating the acquisition of land for public projects, roadside land prices are used as the basis for calculating taxes, it is necessary to conduct a thorough investigation from the perspective of tax fairness and the appropriateness of the valuation. Therefore, the number of survey points is approximately 336,000, or 13 times the number of publicly listed land prices (26,000 points).

Although this is only a rough estimate, it is said the roadside land price is equivalent to approximately 80% of the declared value or the market value. If there are no publicly listed price references or past transactions in the vicinity of the assessed property, many people may use the roadside land price as a reference.

Trends in Roadside Land Prices in Fiscal 2023

Although we use roadside land prices as a reference for our assessments, the party who owns the property may not rejoice at the increase. This is because roadside land prices are also used as a standard for property tax assessment by municipalities, and above all, they affect the calculation of inheritance tax. If roadside land prices start to rise, the amount of taxes to be paid will also increase.

Let us look at the rate of increase in such roadside land prices.

Since it is better to check the detailed rate of increase and specific amounts for each area from the road price maps and valuation multiplier tables of the Property Valuation Standards published by the Ministry of Land, Infrastructure, Transport and Tourism, this blog will explain the most prominent trends.

If you want to check specific areas directly, please refer to the following URL.

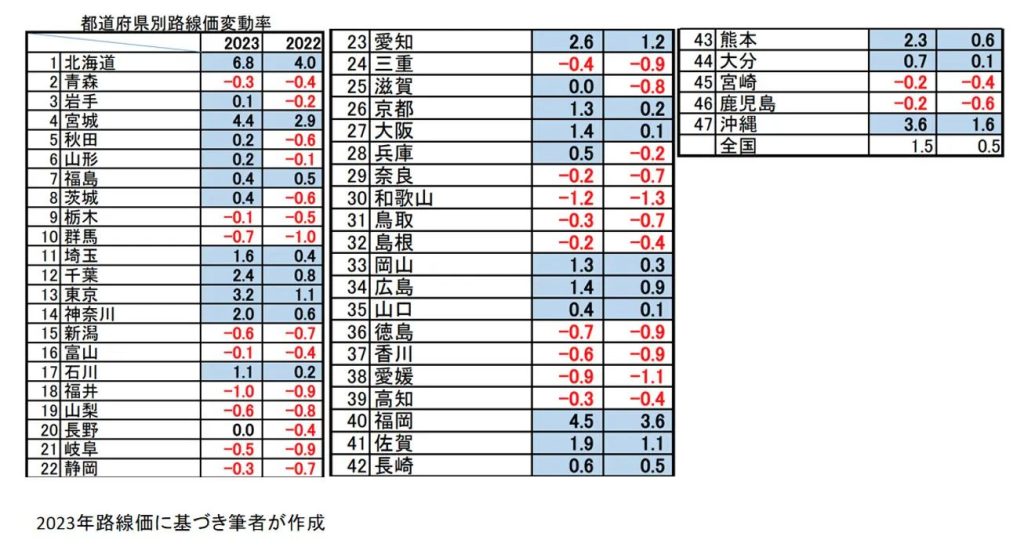

There were 29 cities where the highest road prices increased, 13 cities where they remained unchanged from the previous year, and only 4 cities where the highest road prices declined from the previous year. The national average increase from the previous year was 0.5%, while this year’s increase was 1.5%.

One of the characteristics for this fiscal year is the recovery of commercial land. In particular, the increase has been particularly pronounced in prefectures which are focusing on development in anticipation of inbound demands as other factors.

The highest land price in Ginza 5-chome, Tokyo, in front of Hatodo known to all real estate agents, has been the highest for 38 consecutive years, rising 1.1% from the previous year to 42.72 million yen per square meter.

However, the land price in 2020 was 45.92 million yen per square meter, the price once turned downward due to the pandemic, and is now slowly recovering.

In terms of the average rate of increase by prefecture, Hokkaido ranked first, with a 6.8% increase over the previous year, followed by Fukuoka with 4.5%, and Miyagi with 4.4%. In all of these prefectures, the cities where prices rose in line with increased investment demand and expectations due to planned redevelopment projects led to the overall increase.

In Hokkaido, the top-ranked prefecture, land prices increased significantly as land transactions around Sapporo Station became more active in preparation for the extension of the Hokkaido Shinkansen bullet train to Sapporo. The opening of the Kitahiroshima Baseball Park (ESCON Field HOKKAIDO), home of the Nippon Ham Fighters, was also a factor. Although not reflected in the current year’s land prices, the construction of the next-generation semiconductor manufacturing plant “Rapidus” in Chitose City is expected to start in the near future, and the construction-related companies in the surrounding areas of Chitose City are competing for rental housing, which has led to an increase in land values. The land values in the upcoming fiscal years should be interesting to see and analyze.

In Fukuoka Prefecture, Fukuoka City is the driving force. In particular, the “Tenjin Big Bang,” the large-scale redevelopment of the Tenjin area, is a key factor. The battle for commercial buildings, in anticipation of a large supply of office space due to the redevelopment, is one factor. Also Kurume City, which is the residential zone for commuters to Fukuoka City, has seen the largest increase since the bubble economy. With Nishitetsu Kurume Ekimae Dori in particular rising 19.1% year on year.

It is probably unnecessary to explain the fact that large-scale development raises prices in the surrounding areas, but the Tenjin Big Bang has increased the number of people avoiding Fukuoka City, where prices are rising, and targeting Kitakyushu City, where prices are somewhat undervalued. This has stimulated demand for stores and rental apartments, resulting in a 15.9% increase in roadside land prices.

In Miyagi Prefecture, the third-ranked prefecture, although there is no large-scale development compared with the top two prefectures, demand for condominiums and offices has recovered as the impact of the pandemic has eased, and demand for redevelopment has been stimulated. Sendai City, with its large commercial facilities, is leading the entire prefecture.

A survey of each of the prefectures that experienced an increase of 3% or more confirms, to a greater or lesser extent, redevelopment has had no small effect on real estate transactions.

As you can see from a reading the rate of change table above, even though there is a lot of noise about the national average increase in land prices, there is not actually a uniform increase across the country in actual transactions, declared and market values, or land values.

It is just that the outstanding drivers are raising the averages. This analysis becomes even more striking if we drill focus in on municipalities and specific areas, confirming that this is indeed a polarizing.

Whenever an article is published about the national average increase in land prices, even those in areas which have turned negative may look at the appraisal report we have prepared and complain, “Land prices are supposed to be rising nationwide, so why are they lower than the appraisal results we did a few years ago!” In such cases, it is necessary to explain there are good reasons for the increase in price in said areas.

A small note to keep in mind, the road value year when calculating at the time of inheritance registration

In addition to the factors behind the increase in roadside land prices, it is important to keep in mind the tax knowledge regarding the mandatory registration which will take effect next year (April 1, 2024).

With registration becoming mandatory, land, houses, and other properties that were previously unregistered will be registered one after another.

However, if there is a dispute over who will inherit the property and it is unclear who will inherit the property, it is necessary to be careful when the property was supposed to be inherited according to the legal remainder but was eventually inherited solely by the inheritor and then registered. In such a case, the inheritance tax has already been paid.

In such cases, even if inheritance tax has already been paid, an amended return is required, in which case an additional tax may be imposed in addition to the delinquent taxes.

In this case, you may be wondering whether the roadside land price for calculating inheritance tax is based on the year when the inheritance occurred (the date of the decedent’s death) or the year when you learned of the inheritance.

In the case of filing inheritance tax returns for the time being, ownership of land and buildings is often divided proportionally based on the legal interest, and a new estate division agreement must be prepared if the property is to be owned solely at the stage of registration.

Although there is a time limit for filing inheritance tax returns and for the right to claim recovery of inheritance, there is no statute of limitations on the agreement on division of property. If all heirs agree, the division of the estate can be redone (re-discussed) at any time.

However, if the ownership of a property that was originally intended to be acquired by each of the legal heirs according to the legal interest is changed to sole ownership, it is considered a “gift” under the tax law. If a consideration is paid to prevent this, a “sale” will have occurred and gift tax and income tax may be incurred, so please be careful.

It is also necessary to learn about inheritance tax, as there may be cases where people are hesitant to register their property due to the increased roadside land price.

Summary

As is the case with the roadside land prices explained in this article, the reason for the increase is that the official and prevailing prices are rising. Only roadside land prices will not increase if the declared values do not.

It is a good thing that land transactions are activated and prices go up, but as you can see from the roadside price trends explained here, the impact of the corona virus pandemic has calmed to some extent, and the increase in inbound demand and the resulting demand for commercial facilities have activated transactions causing prices to go up.

Although the surrounding areas are also affected in terms of prices, the trend of price hikes is seen in many parts of the country, which is hindering the actual demand for condominiums by city residents.

While condominiums in good locations are selling well, detached houses are predominant in the surrounding areas where prices have risen as a result.

With land prices rising and construction unit prices also rising, the number of new detached housing is said to be on a downward trend.

Even though orders for custom-built houses are decreasing, work must be created for employees and subcontractors. In the city of Sapporo, where the original author works, there are currently more than 1,000 units in inventory, compared to an estimated 500 units in a typical year.

Some builders are discounting without regard to profit because they cannot recover their capital if the units do not sell, and a salesman I spoke with the other day mentioned, “They (customers) won’t even take a look without a 2-3 million yen discount.”

It will be necessary to develop a calm sales strategy by taking into consideration the roadside land prices in the company’s trade area and accurately grasping the situation where sales are bifurcated into the central Tokyo area where sales are strong due to redevelopment, and the surrounding area where sales are stagnant due to the rising land prices.

Original Article: 【全国平均は2年連続で上昇】国税庁が発表した令和5年度の路線価傾向について

For additional information or any questions please contact us here

Email: info@remax-apex.com