Why “Leaseback”

Recently, the decrease in the number of auction applications has become a hot topic in the real estate industry.

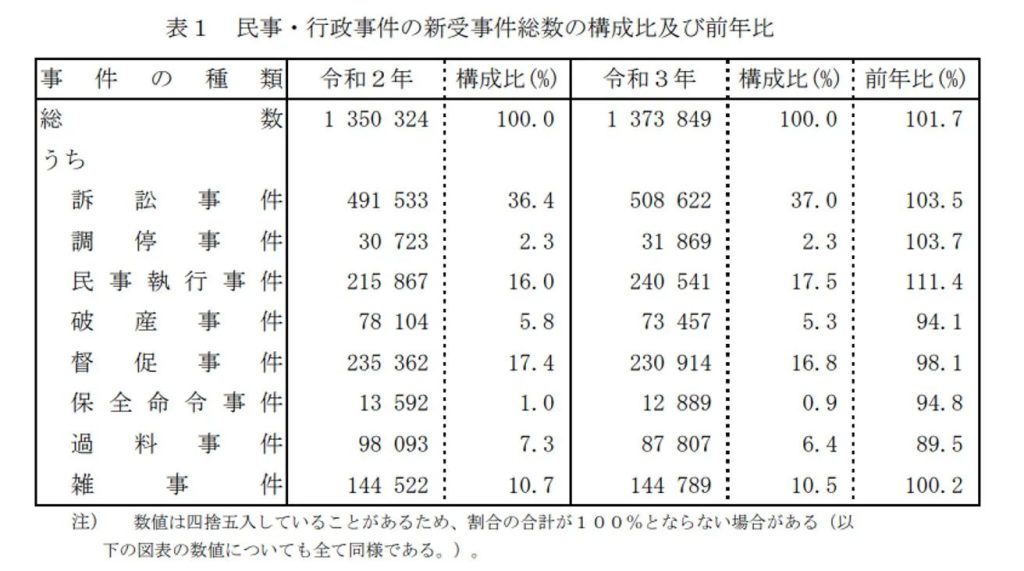

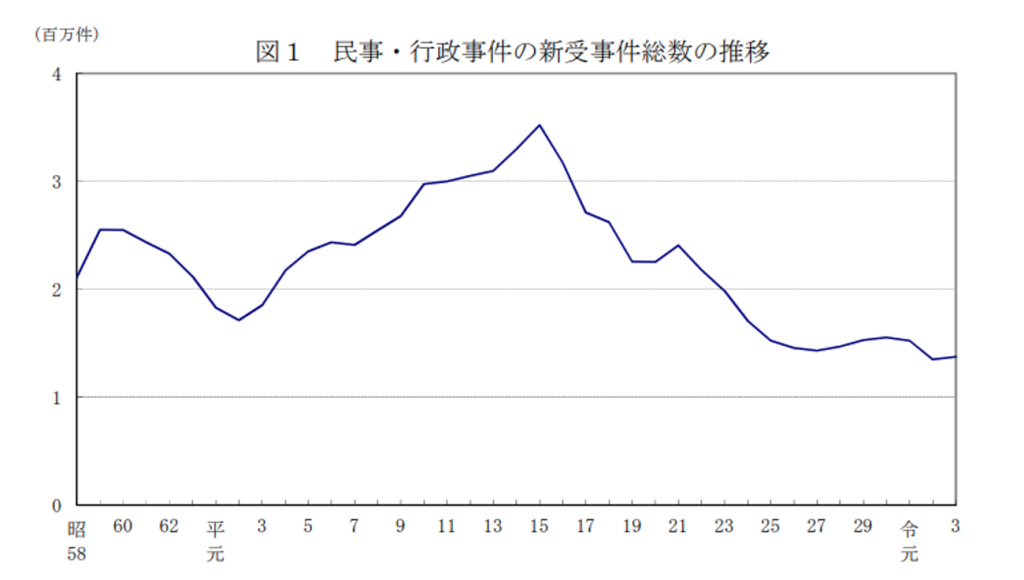

According to the Annual Report of Judicial Statistics, the total number of civil cases has increased slightly.

This tendency can be seen particularly in litigation, mediation, and civil execution, but on the other hand, it can be seen that bankruptcy and dunning cases are decreasing.

Needless to say, an auction petition is classified as a civil enforcement case.

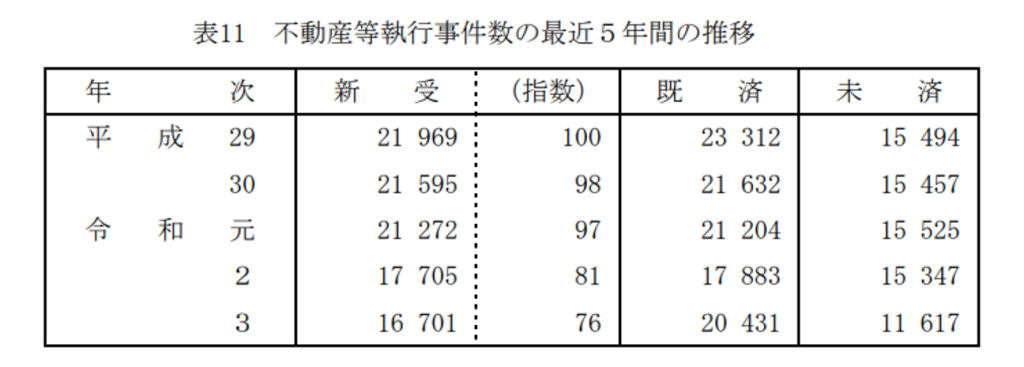

Looking at only the year-on-year rate of change, the number of civil execution cases was 111.4% compared to the previous year, but if we look only at real estate execution cases, we can confirm that it has continued to decrease over the five years including 2021.

Looking at this, it is premature to think that the number of people who are in trouble with their mortgage payments and are behind in payments has decreased.

It is generally believed that the number of real estate execution cases, such as auctions, has decreased because such people consider it as a means of self-help therefore actually adopting it.

Since the clearest evidence has not been presented, it is only speculation that it is probably so.

However, in order to differentiate from other companies, the number of companies that specialize in selling without a doubt is increasing, and the number of companies that handle leasebacks is also increasing.

Leaseback itself can be a relief for those in need of mortgage payments as long as it is managed properly.

Even if it is somewhat cheaper, you can receive the sales proceeds in a lump sum.

And even if it is a little expensive, you can continue to live in your house by paying the rent.

In this case, I think that some “loss” on the part of the original owner should be accepted as there is a corresponding risk for the buyer (company), but that is also a matter of degree.

The purchase price was extremely low compared to the marketability, or even though the seller was initially told that even if it was a fixed-term lease contract, it could be renewed, the seller was refused to renew the contract after the expiration and was kicked out of my home. Problems such as this occur frequently, and the impression of services that are originally beneficial to both parties is becoming biased toward a bad image.

It is not limited to traders, but everyone wants to think that if you buy it, it will be as cheap as possible, and if you sell it, it will be as expensive as possible.

The larger the difference between the purchase and sale price, the more profit you will make, hence if you consider the investment amount and return required for each investment, you may have a bad perception to this concept.

There are varying reasons to why consumers (real estate owners) decide to “leaseback” there homes, above are a couple of examples. The majority of cases to be financial can be assumed.

What is “Leaseback?”

Let’s limit the type of properties to residential for this explanation.

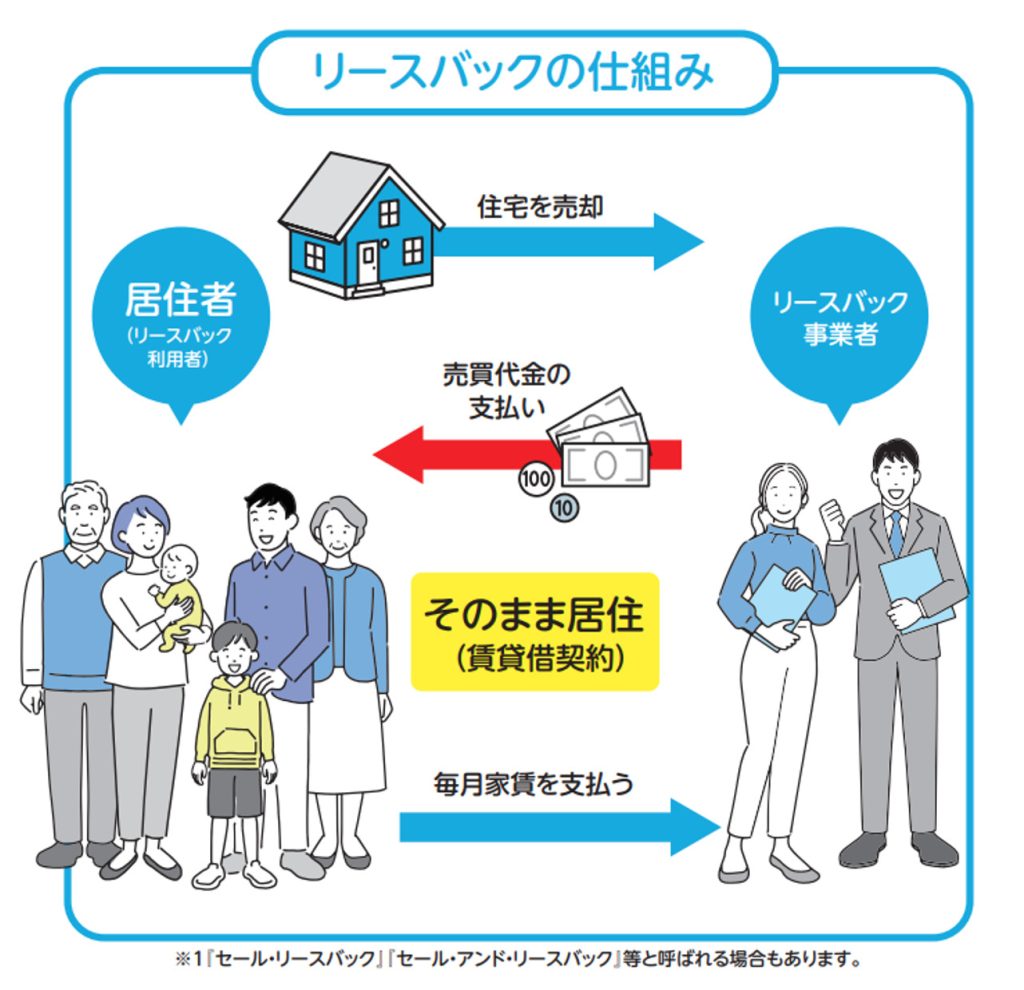

“Leaseback” will be a transaction that enables you to continue living in the house as before by selling the house you own to a third party and then entering into a lease agreement with the third party.

According to the guidebook by the Ministry of Land, Infrastructure, Transport and Tourism, it is defined as “a service to continue living in the house you lived in by selling the house, earning cash, and paying the rent every month after the sale.”.

In this case, the third party that becomes the buyer and lessor is often a real estate agent or company, especially a company that focuses on the purchase and resale business.

“We are adopting it as a tactic to actively expand the frontage of purchase projects.” – Real

Estate Company who focuses on purchase of properties for the purpose of resale.

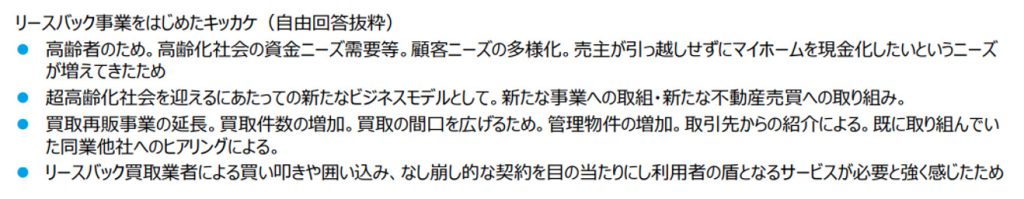

Behind the spread of leaseback is the diversification of customer needs, such as those who are having trouble paying their mortgages but want to cash out their homes without moving if possible, and elderly households who may need the funds.

If you want to learn the basic idea, please read the “Guidebook on Housing Leaseback” provided by the Ministry of Land, Infrastructure, Transport and Tourism at the following URL.

https://www.mlit.go.jp/jutakukentiku/house/content/001489269.pdf

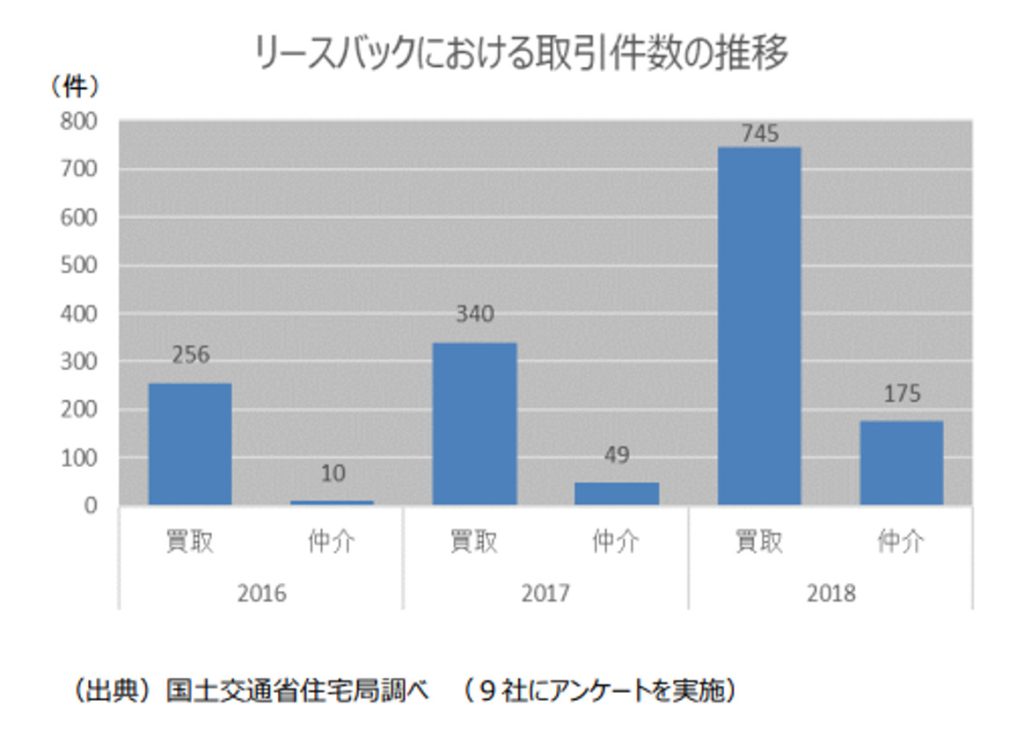

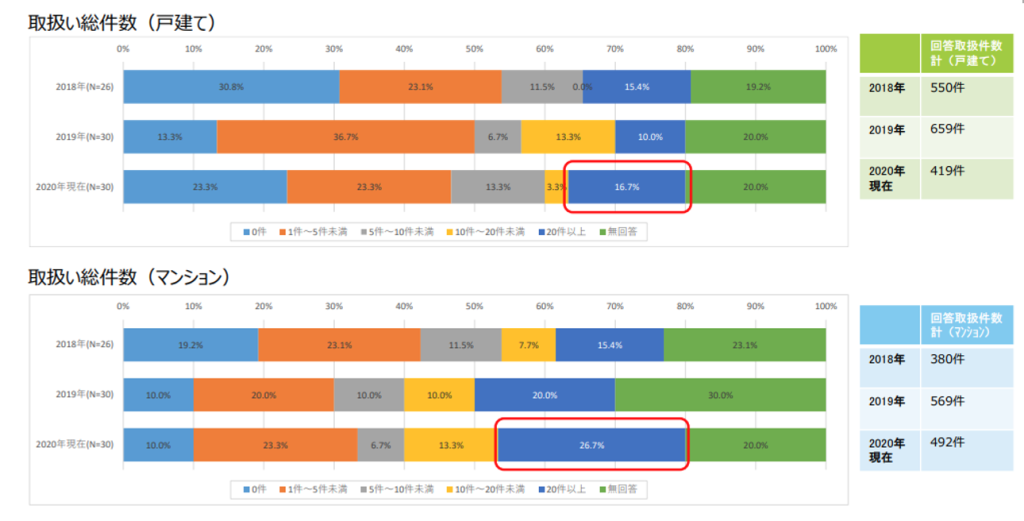

Is the Number of “Leaseback” Transactions actually Increasing?

If you search the Internet, you can find many articles that warn against leasebacks.

Even after obtaining the funds for the sale, you will still need to pay the rent, but you can continue to live in the house without moving, which can be wonderful advantage.

We often hear that there is an increasing number of people in the general public who fear that they will be taken advantage of real estate agents and or companies, but even with the general public fears, the number of “leaseback” transactions are increasing.

It is believed that, relative low level of awareness and the fact that the series of procedures that combine a sales contract and a lease contract are complicated for the general public. One of the causes of trouble is signing a contract without fully understanding the details of the contract. Which is an issue in any industry or concept.

It’s a great system if it’s used correctly, but it’s a pity that some untrustworthy agents and or companies, who focus only on the potential profits, are causing misunderstandings among general consumers.

Those who are in the industry whom are thinking of working on leaseback in the future need to deepen their understanding of the essence (why) and the benefits if done correctly, to reassure consumers who are skeptical.

Recognition of “Leaseback”

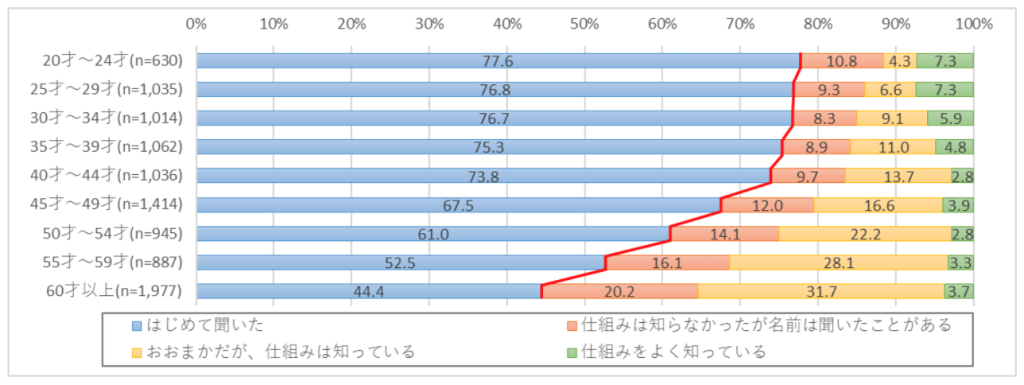

Now let’s think about how much the general public is aware of the “leaseback.”

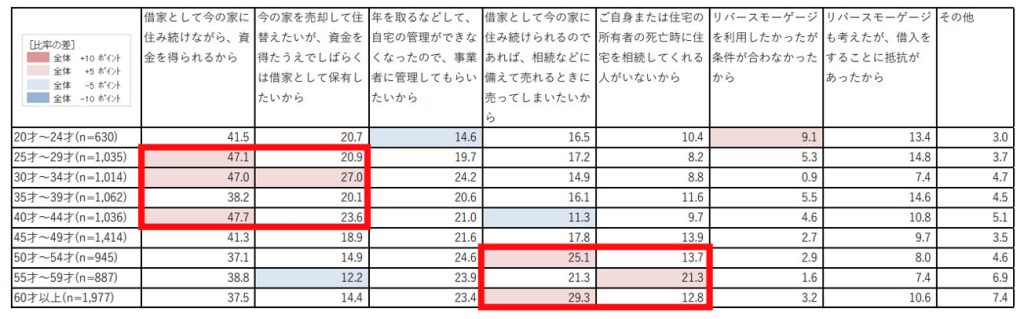

According to the results of a survey by Value Research Institute, Inc., general consumers’ awareness of leasebacks is about 22% overall.

However, it has been confirmed that the higher the age, the higher the recognition, and 65.6% of those aged 60 and over answered that they have heard the name or know it in detail.

Relatively young households are considering using leasebacks for the purpose of obtaining cash, but it has been confirmed that the older the households, the more likely they are to consider future inheritance.

Reverse mortgages, which are often compared to leasebacks, do not seem to be “received well,” and even in the results of a survey of elderly people, they answered, “I have considered it, but I am reluctant to take out a loan.” It would be interesting to see how many have.

Rent Calculation Method

Let’s consider the purchase price of the property, not just the leaseback.

If it is a simple purchase (real estate flip), 70 to 80% of the assessed amount (market value) is common.

However, in the case of leaseback, the original seller becomes the lessee and continues to live in the property, thus resale profit cannot be obtained immediately.

Therefore, it is necessary to consider the risk of falling real estate prices as well as the yield of rental income.

In this case, the rent setting amount can be applied to the following formula.

Purchase Price ×(6~8%÷12 months)

Considering the property prices that are currently rising, the yield is at most 6 to 8%.

If you try to secure this 10% or more, you will have to lower the purchase price. This where the conflict of interests arises.

The rent should not be set simply based on the yield calculation. Agents or companies should calculate the final rent amount by looking ahead and taking into consideration the surrounding rental market and capital gains (profit on sale) that will be obtained at the time of resale.

As long as there is a corresponding risk for the purchaser, the purchase price tends to be low even if calculated normally, and the rent tends to be high.

The agent or agency has no choice but to patiently explain how much risk there is to the purchaser and how much benefit there is to the user and gain their understanding.

Challenges for Real Estate Agents

Even at the study group that was launched with the aim of formulating the “Guidebook on Residential Leasebacks” mentioned above, some buyers acted as a “shield” after witnessing bargaining, enclosures, and break-through contracts by some purchasers. Comments from vendors who began to work out of anger, such as one who answered that the reason was because they felt strongly this service was necessary.

If used correctly, “leaseback” will definitely be a useful system for consumers.

What the consumer needs to know is to think about is how you are involved, your role. As you know, just purchasing directly is not a leaseback.

For investors and those who do not plan to move in immediately but would like to acquire a property now, there is one form of “brokerage of leaseback transactions”.

Also, depending on the flow, you may entrust the agent or agency with the management of the rental contract as well as the mediation, therefore the total commission will also increase compared to simple trading.

In addition to expanding knowledge about leaseback, depending on the case, it may be advantageous for the client to adopt other asset utilization methods such as reverse mortgages.

It is important to develop a better understanding of such methods.

In addition, especially for those whose main business is buying and selling, there are cases where they do not accurately understand the merits and demerits of fixed-term building lease contracts, which are often adopted for lease contracts in leaseback.

In order not to make consumers uneasy, both parties need to better understand the concept of “leaseback” and why it is utilized.

For additional information or any questions please contact us here

Email: info@remax-apex.com