Original Article: 【顧客がネット銀行を利用すると言っているのですが……】ネット銀行の注意点とローン特約の見解

The other day I was asked, “A customer says he is applying for a loan on their own, in such a case, how should I proceed with a loan contingency?”

There is no problem if the buyer chooses the lender and handles all the application procedures and negotiations with the financial institution by themselves.

Therefore, there is no way to resist a customer who declares, “I will decide on the lender and do all the application procedures myself.

Once approved, all you have to do is confirm the name and contact information of the loan officer and coordinate the settlement process.

The problem is when the loan is denied.

Normally, when financing is used for a purchase, a “loan contingency” is established. If a loan application is denied, a contract is unconditionally canceled unless there is an application delay or a breach of conditions. However, if it is canceled outright, we, mediation contractors cannot obtain remuneration.

Therefore, on the seller’s, even if there is an approach of purchase, they may ask “Is financing going to be an issue?” Thus, it is necessary to be prepared so that the other party (seller) may not feel uneasy, and the buyer’s side may give a reasonable explanation about the credit capability of the client.

Some sellers or seller’s representation may refuse to accept a purchase applications from those who have not been pre-approved.

Apart from the appropriateness of such a condition, we understand the reasoning behind the condition.

The reason for my opening question is that the lender to which the client plans to apply is an online bank.

As you know, online banks, with a few exceptions, do not have manned branches. In addition, they do not accept any intervention by intermediaries in the application process.

Only the person who has applied for the loan (you can ask for a printout of the application amount, etc.) can know how much you have applied for and how the screening process is progressing.

In other words, we are left largely out of the loop when it comes to loans.

As a person in charge who wants to know about the status of the screening process, I naturally felt uneasy.

So, I suggested that they apply to a financial institution where I could apply on their behalf, saying that they could withdraw the application if they received approval from an online bank. However, the customer objected, “Why should I apply to another bank with a higher interest rate?

The customer is the one who will continue to repay the loan over a long period of time, so there is no mistaking this argument. The customer has the right to choose where to apply.

Recently, we have been hearing more and more cases similar to this one. Internet banks are characterized by generally low interest rates because they have no manned branches and can reduce labor costs. It is natural for customers to want to use a financial institution that is as advantageous as possible.

For example, AU Jibun Bank was offering the lowest interest rate as of March 2024. The most favorable variable interest rate is 0.169%.

This is an interest rate so low that most financial institutions with manned branches cannot compete.

However, online banks tend to lack know-how and data on mortgage loans, and are generally said to have a “strict screening process” due to their idiosyncrasies in judging loans based on documents alone.

Unlike the typical financial institutions, they do not conduct face-to-face meetings, so they have no choice but to screen carefully. As an intermediary who understands the characteristics of such banks, it is natural for me to want them to apply to other banks for the sake of time preservation and to have the offer reviewed by the seller.

In this blog, I would like to explain about self-loans, focusing on online banks, where usage is likely to increase in the future.

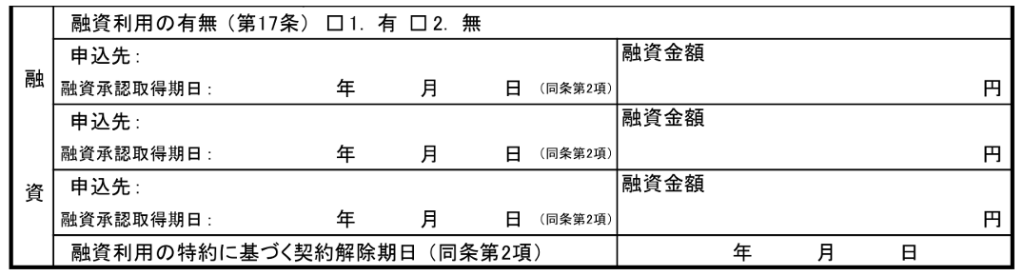

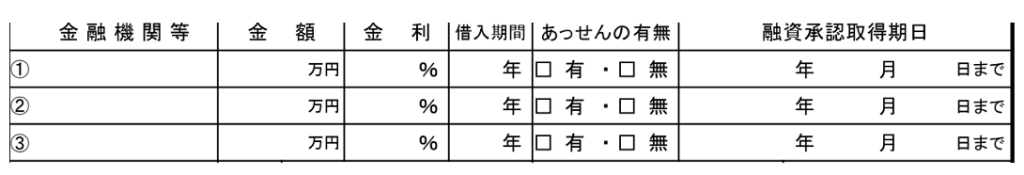

Basics of Loan Utilization Agreements (Contingencies)

With a few exceptions, such as when the customer works for a financial institution, the customer’s knowledge of mortgages are limited. Even if the loan officer kindly explains the mortgage, the customer may need time to fill out the forms and prepare the accompanying documents.

Special terms and conditions of loan use, so called “loan provisions,” are not applicable unless predetermined conditions are met.

It is assumed that you will first apply for the loan without delay, based on the name of the financial institution you plan to apply, and the details stated in the sales contract, including the approval income date and the amount to be used.

The right of cancellation can then be exercised only if approval cannot be obtained for all or part of the loan.

To exercise a right, it is a precondition that the scheduled application to the financial institution, conditions, etc. are clarified, and the seller understands them.

There is often a person who misunderstands that “it is a buyer and the representation who decide the amount for a loan and various conditions” and cannot be involved as a representation of the selling side.

Since joint mediation is based on the premise of advancing a deal in cooperation, it is necessary to make an appropriate proposal and advice while considering the customers of both sides, regardless of the position.

After these procedures are taken, the amount of money to be offered is described in the Article 37 document (sales contract), and the interest rate, etc. are described in the Article 35 document (explanation of important matters).

The requirement is that the application is submitted as scheduled and approval is not granted for all or part of the loan. However, this also includes approval responses due to changes in terms and conditions, etc.

For example, a reduced application amount (a loan application for 20 million yen can be approved for 16 million yen), or limited approval (the planned guarantee company cannot be used, but approval is granted if a company with a higher guarantee fee is used).

In this case, the former can be settled if the deficient amount is available, and in the latter, the desired amount can be borrowed by paying a relatively high guarantee fee.

However, that is not the original plan. In such a case, it is up to the buyer to decide whether to accept the conditions and settle. Naturally, it is also possible to exercise the right for the “loan provision” and cancel the contract outright.

Exercising the right to terminate the agreement is done by contacting the seller without delay if the planned financing is not available. However, it is premature to say that the delay in contacting the seller immediately disables the exercise of the right.

This is because there was a court case (Fukuoka High Court, August 1999) which ruled that even if an offer is made without delay after the conclusion of a contract, if the offer is not executed by the due date (approval is not obtained), the sales contract is naturally canceled by that due date, unless another extension of time has been agreed upon.

However, even with this judicial precedent, a dispute will arise if you fail to contact the seller. If the preconditions are different, there is a possibility that the contract will not be terminated as a matter of cause.

It is important to understand that this is only a consensual release.

Things to Consider when Clients Find Their Own Financing

If the buyer wishes to apply at an online bank, the condition should be that the application be made to a financial institution where we can engage as a conservation measure. The aforementioned agent mentioned above also thought so and proposed it, but he said it was stubbornly refused.

It is questionable whether the general public will be able to apply without delay, comply with deadlines and application conditions, and accurately track the progress of the application and report the results. In the worst case scenario, there is a possibility that the contract cancellation under the loan provision will not be approved. This is an unfavorable outcome for the buyer.

The buyer should be carefully informed of this risk and encouraged to understand it. At the same time, if the buyer’s intention to purchase the property is clear, the need for preservation should be emphasized.

However, even if you apply as a safeguard, if the loan is approved under the conditions stated in the contract, etc., a special loan agreement will not be granted.

A customer who had objected, “Why should I apply to another financial institution with a higher interest rate?” may express concern about using a lender to which they had reluctantly applied.

Therefore, “If you are approved by an online bank, all you have to do is withdraw the application as soon as possible.” In the unlikely event that your loan is denied, are you willing to give up on purchasing the property?” It may be a good idea to reconfirm your intention regarding the purchase and, at the same time, talk reasonably about the fact that the screening process at internet banks (Neobanks) are generally very strict.

Of course, you should also convince them that if the loan is approved only at the proposed financial institution, you will have to use that institution.

Regarding the loan provision, the Tokyo District Court stated on September 18, 1997, “the purpose of the loan provision is to require the cancellation of the sales contract for the protection of the buyer in the event that financing is not obtained due to reasons not attributable to the buyer.”

In other words, the buyer is free to decide where to apply for financing and how much to apply for, as long as the interested parties (seller) give their consent.

However, we must not forget that we have a duty to provide appropriate advice and assistance in order to conduct a problem-free transaction.

Process of Loan Execution at an Online Bank

We are sure that you are aware that you can search for precedents related to real estate on the website operated by RETIO (Real Estate Proper Trade Organization).

If you search the site by specifying “Loan Cancellation/Cancellation by Special Agreement” among disputes related to buying and selling, you can check the history of 38 cases as of the date of writing (March 12, 2023).

Looking through the summary, we can see various cases as follows;

- A case in which a buyer, who was forced to cancel a deposit by the failure of an intermediary company to notify the seller of the fact that the loan was rejected by the cancellation deadline, sought compensation for the amount equivalent to the deposit against the intermediary company, and the claim was approved on the grounds that there was a breach of duty under the rules of faith (Tokyo District Court, October 22, 2021, Westlaw Japan)

- The mortgage loan was approved on the condition that a joint guarantor be appointed, but the loan became unavailable later because the joint guarantor could not be appointed. The buyer wished to cancel the loan based on the loan covenant, but the court ruled that the loan provision did not apply because the inability to set up a guarantor was a cause attributable to the buyer (Tokyo District Court, August 10, 2021, Westlaw Japan).

- In a case where the deadline for settlement was extended for the convenience of the buyer, the court held that the provision on financing would lose its effect unless there was a clear agreement again from the seller (Tokyo District Court, June 11, 2019, Westlaw Japan).

- A case in which the application of loan clauses was allowed even if prior approval had been obtained, if approval had not been obtained through formal examination by the loan approval date (Tokyo District Court, January 9, 2019, Kinyu Homu Jijo 2120) -76)

- In a case where the reason for rejection of a loan application by the buyer was because the loan was not in accordance with the terms and conditions presented by the financial institution in advance, the court held that the loan terms were not applicable (Tokyo District Court, April 18, 2014, Westlaw Japan).

The examples presented are only a partial summary. Different assumptions will naturally lead to different decisions.

If you want to check the details, you should access the website and read the explanatory articles.

In any case, it is important to understand that there are many cases of disputes regarding the setting and advising of loan provisions, and it is important to try and explain carefully from the viewpoint of preventing such disputes. At the same time, it is important to supplement the explanation by checking the levels of understanding.

Summary

Because a loan provisions is for a blank cancellation without penalty, if the right is exercised, not only the seller but also we who are involved in mediation cannot obtain any profit.

Since all efforts, such as a preliminary inspection, negotiation, and contract preparation work, become pro-bono, it is something to be avoided as much as possible.

However, the failure to obtain financing approval is a force majeure event, and it would be cruel to place the blame on the buyer and forfeit the deposit. Therefore, the loan provision has been established to protect the buyer.

The buyer is not obligated to consider other financial institutions just because the loan is denied. Therefore, there is no need to revise the terms of the application or consider other banks for financing out of a desire to somehow close the deal, and we cannot force the buyer to do so.

We will simply explain the possibility and assist the buyers at their request.

For additional information or any questions please contact us here

Email: info@remax-apex.com