Original Article: 【返済期間50年は誰のため?】価格高騰で増加する長期ローン斡旋時の注意点

The soaring prices of materials and inflation, partly due to the weak yen, and the rise in land prices, which have risen as if in response, have cast a pall over the number of new real estate sales and purchases.

While some tower condominiums are selling well despite the price hikes, such as those purchased by wealthy foreign buyers and corporations, an increasing number of construction companies are going bankrupt because they cannot sell as predicted as they would like to cover the decline in sales of custom-built houses due to the pandemic.

In the current situation of extreme polarization, it is necessary to take stock of one’s own strengths and take some measures to stabilize business, rather than repeating the old ways.

Financial institutions are similarly eager to increase the number of mortgage loans, which have a much lower default rate than business loans.

However, real estate prices are rising for the reasons mentioned above, and with the average salary of 4.58 million yen in the National Tax Agency’s 2022 survey of private-sector salaries, which was released in September, new construction is at a premium.

Calculated at the average annual income, the repayment burden rate of 20%, which is considered a safe zone, is about 76,000 yen per month, so at the interest rate of 3-4%, which is the screening interest rate, you can only borrow 17-19.83 million yen for a 35-year mortgage.

In reality, it is possible to borrow more than this amount, taking into account the employer and other factors. However, customers realize that “borrowing is not the same as being able to repay the loan,” and an increasing number of households will give up on real estate purchases.

In particular, the trend among the Generation Z (born between 1999 and 2015) and the Satori Generation (born between 1987 and 2005), which includes the generational group that will purchase the largest number of properties in the future, is becoming more and more pronounced: they are pragmatic, not greedy, and do not “take on too much.”

Various surveys have confirmed the overall trend is a lack of materialistic desire, especially when it comes to real estate purchases, and they “don’t want to force themselves to buy.”

Financial institutions, which must invest their funds to earn profits, just as we cannot earn profits without selling, want to maintain, or at least increase, the number of mortgage loans with low default rates, rather than decrease them.

This may be the reason why an increasing number of financial institutions are starting to offer mortgages that can be extended for up to 50 years.

The longer the loan term, the lower the monthly repayment amount and the lower the repayment burden ratio calculated by the interest rate, which means “more loans can be taken out even with an avergage income.”

However, this is a long-term loan of 50 years. There are probably a variety of problems which may arise if explanations are not provided.

In this article, we will explain the risks you should keep in mind when proposing a long-term repayment.

Advantages of Long-term Borrowing

Even if 50 years is an extreme case, we, who introduce mortgages with long-term payments, need to be familiar with both the advantages and the disadvantages of different mortgages.

Although it is the job of financial institutions to explain mortgages, it is rare for the general public to understand the product trends of lenders, so in reality we are the intermediaries, including the selection of lenders.

Perhaps it is because each salesperson has different knowledge about loans, but there is no shortage of cases on the Internet of people who have made the mistake of taking out a mortgage at the behest of a salesperson.

Therefore, it is necessary to learn more about the details.

Let’s start with the advantages of taking out a long-term mortgage.

- The monthly repayment amount can be reduced (as a result, the repayment burden rate can be lowered and the amount borrowed can be increased with longer terms)

- The real estate market can be expected to be stimulated by the decrease in the repayment amount

- Flexibility to make early repayments and shorten the repayment period if income increases is a possibility in the future.

- Increased borrowing amount will allow for a wider range of property selection.

- Longer repayment terms will allow the borrower to have more cash on hand to save and prepare for the future.

- Group credit life insurance is also taken out for the same period of time.

- Some financial institutions offer products which allow borrowing from credit card loans, etc. to be consolidated into one loan. In addition to registration fees and other expenses, making it easier to make a financial plan.

Potential Risks

There are positives and negatives to everything, so it would be one-sided if we only emphasize the advantages and not explain the disadvantages.

Let us consider the disadvantages of long-term borrowing.

1. Increase in Total Repayment

This is probably the most significant disadvantage.

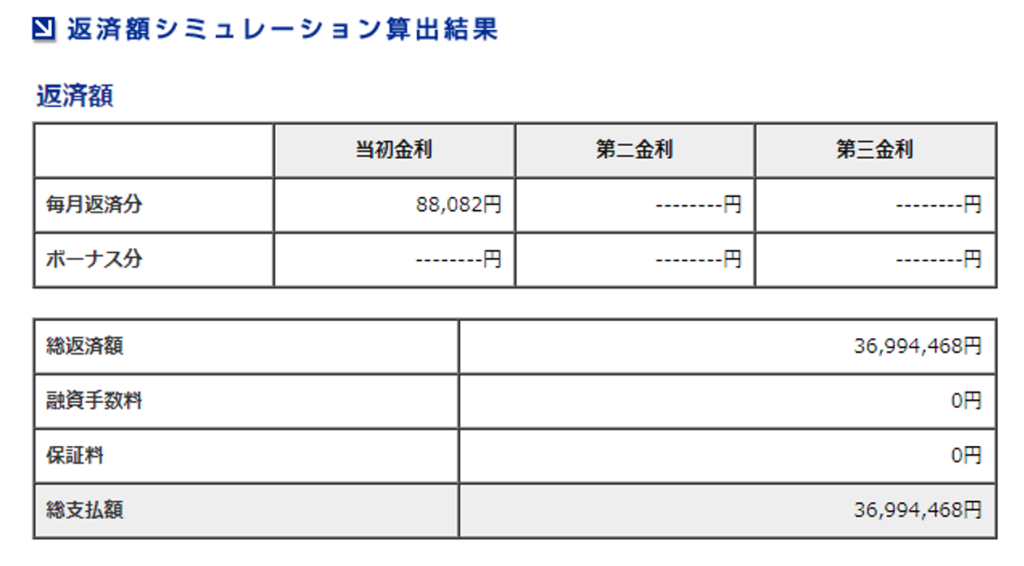

As an example, the following figure shows a simulation of borrowing 30 million yen at the new Flat 35 lending rate of 1.24% at the time of writing, with a term of 35 years (fixed, no bonuses added).

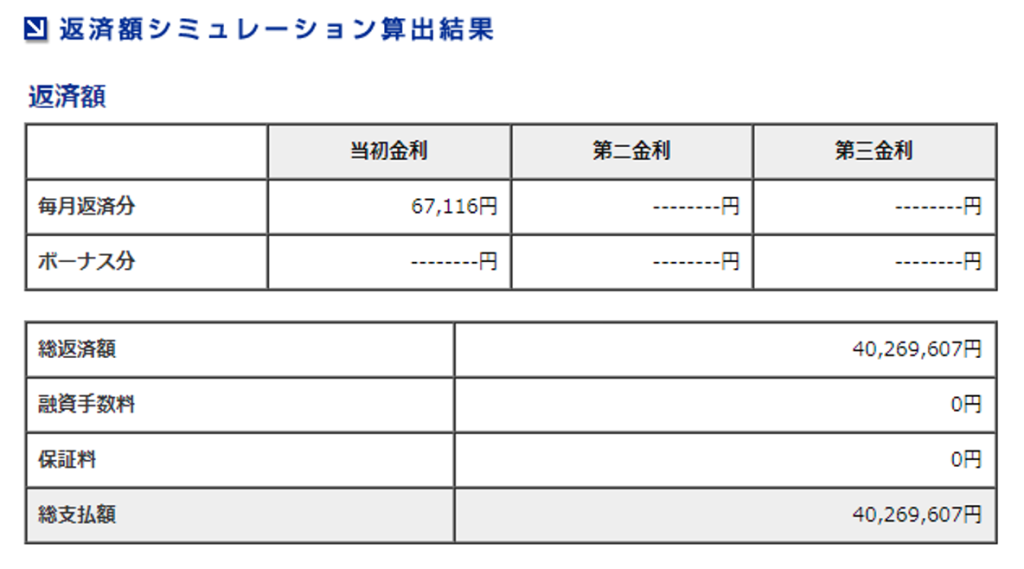

This is the case when the interest rate and other conditions are the same and the repayment period is set at 50 years.

The monthly repayment for 35 years is 88,082 yen, whereas the monthly repayment for 50 years is 67,116 yen, per month respectively.

The monthly payment is 20,966 yen lower per month.

Even if the loan amount is the same, the monthly repayment amount will be lower if the term is lengthened.

This also lowers the repayment burden ratio, so it is more likely that you will be able to obtain additional financing.

But don’t lose sight of the total payment amount.

The total payment for a 35-year loan is 36,994,468 yen, whereas the 50-year loan is 40,260,607 yen, or an increase of 3,266,139 yen in the interest alone.

Customers tend to focus on the immediate payment amount, but we need to explain to them that the total repayment amount will increase.

2. Risk of Interest Rate Fluctuation

Even 35 years, which is currently the mainstream, is quite a long time, but 50 years is a period that is equivalent to the average life expectancy in certain eras.

Even if you buy a house and take out a loan at the same time as the birth of your child, your child will be 50 years old by the time you finish paying off the loan. This is a very long repayment period.

During that time, there will be many changes in your personal life, such as job changes, transfers, children entering higher education or getting married, and the birth of grandchildren.

Changes are not limited to personal life, but also includes economic changes.

In particular, you should pay attention to the risk of interest rate fluctuation.

If the interest rate is fixed for the entire term, you may not have to worry so much, but as far as I know, “Flat 50” is the only product which offers a fixed interest rate for the entire term.

Flat 50 is available for both new and used homes, but the house must be a certified “excellent long-term housing.”

In addition to an inspection of the property, an on-site inspection is also required for existing houses, unless certain conditions are met. Thus in principle, the use of Flat 50 is not possible without a certificate of conformity.

Private financial institutions do not have any restrictions on building performance, etc., but they offer only variable, fixed term, or maximum 35-year fixed term options.

After the variable term ends, the borrower must again choose either a fixed term or variable.

The Bank of Japan’s monetary warming measures have reached their limits, and from July 2023, long-term interest rates will be allowed to fluctuate up to 1%.

As a result, long-term interest rates rose, and fixed mortgage rates were raised in tandem, mainly by city banks.

Although short-term interest rates have not been affected thus far, experts believe short-term rates will rise as well.

However, economic trends change over a 50-year period, so it is impossible to be happy or sad only focusing on short-term conditions.

It is necessary for the borrower to keep a close watch on interest rate trends.

3. Pay Particular Attention to Your Age at Repayment

Even if a financial institution offers a mortgage with a 50-year repayment period, the age at which the loan is fully repaid is almost always when the borrowers turns 80 years olds.

In other words, even if you meet the other conditions, such as the performance of the property, you must be under 30 years of age at the time of application to take advantage of the full 50-year term.

Banks Offering Mortgages with a Term of 50 years are:

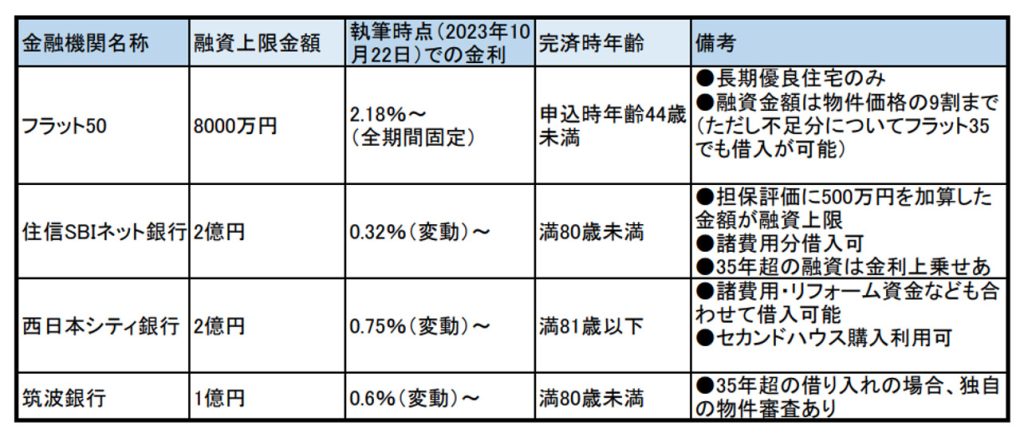

Except for Flat 50, regional banks have been the only mortgage providers which offer mortgages with repayment terms longer than 35 years.

Regional banks have regional restrictions based on their business areas, so borrowers have are not able to borrow anywhere in Japan.

“Flat loans” can be used anywhere in Japan, but with the premise is that only long-term quality housing is eligible.

Recently however, online banks have begun offering mortgages with a 50-year repayment period, making them available anywhere in Japan.

At the time of writing, the main financial institutions offering mortgages with repayment terms longer than 35 years and their terms and conditions are as follows;

However, the trend to consider lengthening the term is increasing, especially among regional banks that want to differentiate themselves in the mortgage market, so the number of options will continue to increase.

However, there are some conditions, such as an interest rate surcharge for loans exceeding 35 years.

You will need to carefully check the loan outline.

Summary

One of the reasons for the lengthening of repayment periods may be because the number of real estate purchases has been declining.

As explained at the beginning of this article, the recent decline in household demand is said to be due to a decrease in housing investment, as property prices have skyrocketed and the generation gap has changed people’s attitudes toward home purchases.

As we all know, the number of new housing has also been declining, but mainstream custom-built housing companies that have not been able to differentiate themselves are breathing a sigh of relief, and the same is true for companies which have specialized in building new homes for sale.

In light of the expected decline in the number of new housing starts, major housebuilders are taking measures to continue their business even as new construction orders decline, by strengthening their renovation and purchase/resale divisions.

Housing support, including tax incentives, is also a significant economic policy measure.

Financial institutions are not being excessively concerned when they offer mortgage loans with low default rates, as it is in line with government policy to provide products which are easier to borrow.

However, it is a problem if people do not face this reality just because it is easy to borrow.

If you take out a loan at age 30, you will be 80 years old when you pay it off (50 year mortgage term).

Even though the average life expectancy has increased, group credit life insurance will probably be applied to a considerable number of cases.

Although there is no problem for the surviving family members, I am left with an unsettling impression.

Who in the world is a 50-year long-term loan for and who does it benefit?

When we offer long-term loans, it is important to consider the realistic solvency of the borrower and to help the borrower make the right choice, taking into account future interest rate fluctuations and excessive burdens caused by lifestyle changes.

For additional information or any questions please contact us here

Email: info@remax-apex.com