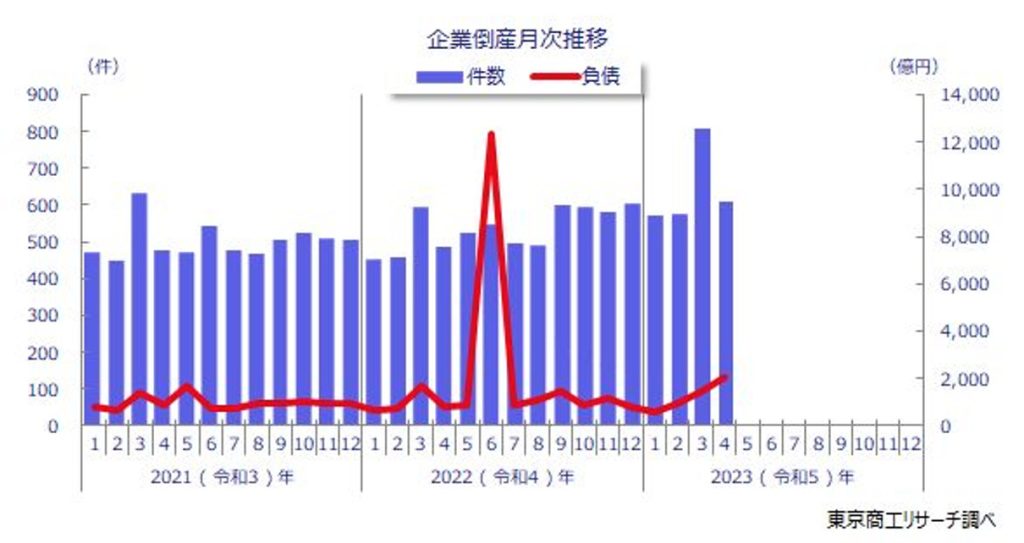

According to information published by Tokyo Shoko Research, the number of corporate bankruptcies appears to be on the rise.

If you are a registered user of Teikoku Databank, you probably check the preliminary reports on a daily basis, and even this fiscal year, there have been several bankruptcies with liabilities of 3 billion yen or more, including a major bankruptcy with liabilities of 100 billion yen in April.

In recent years, however, the number of bankruptcies has gradually decreased from 12,734 in 2011 to 6,030 in 2021, the year of the Tokyo Olympics, but for 2022, this number is expected to rise to 6,428.

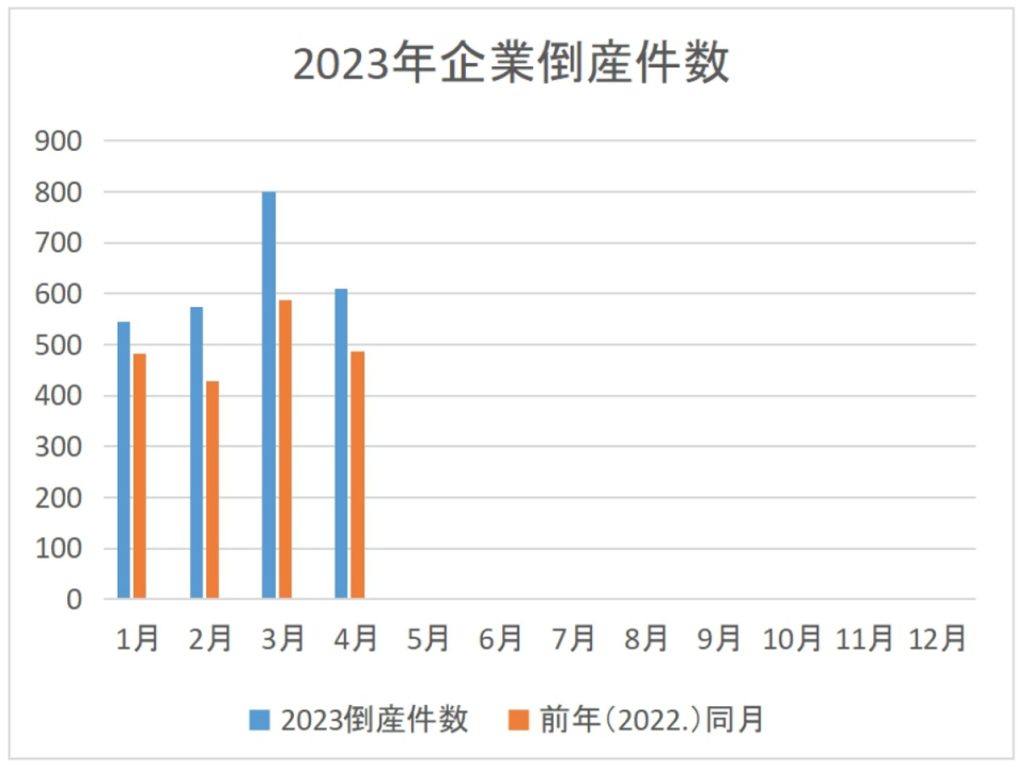

The number of bankruptcies has been on the rise for 13 consecutive months since April 2022. Comparing these numbers to bankruptcies in 2023 based on bankruptcy information published by Teikoku Databank, the number of bankruptcies from January to April was 2,530 (1,984 in total for the same month in 2022), a 28% increase.

At this pace, there is a strong possibility that 2023 will also surpass the total number of bankruptcies from the previous year.

Looking at the most recent bankruptcy trends for companies with liabilities of 3 billion yen or more, we can see that earnings have declined due to the Corona virus pandemic. The aftermath of soaring raw material costs, and intensifying competition from other companies in the same industry.

The so-called “Zero Zero Loan,” which provided virtually interest-free and unsecured loans to companies affected by the pandemic, reached its repayment date including interest payments, in March 2023. For those companies which managed to manage to keep their funds flowing until then, this means that a new round of repayment has begun.

Although the generous support measures have curbed the number of bankruptcies, the excess debt has become apparent due to rising raw material prices and other factors. It is widely expected that the number of companies on the bankruptcy reserve is on the rise as companies are finding it difficult to find new financing with their excess debt.

If a company goes bankrupt, its clients will suffer, but it is the employees who will be even more perplexed.

If you are young and not picky about the type of work you do, you will not have much difficulty finding new employment, but if you are over 45, the job-to-job ratio drops dramatically.

As you may know, the age of 45 corresponds to the age of the head of the household a few years after purchasing a house.

This is because in the “Housing Market Trends Survey Report” by the Ministry of Land, Infrastructure, Transport and Tourism, the age of 40-45 corresponds to the age at which a house is purchased, regardless of whether it is newly built or used.

As a real estate agent, you probably know that the accident rate for mortgages is low because people want to protect their homes, their castles, as their last fortress.

However, this is only a matter of decree.

In general, the mortgage repayment rate accounts for a significant portion of a household’s finances.

According to the latest “Housing Market Trends Survey,” perhaps reflecting the times, an increasing number of people are making sound financial plans, keeping their repayment burden ratio below 20%, but if you own real estate, you need to pay property taxes, maintenance costs, and other expenses other than mortgage payments.

In many cases, depending on personal circumstances, it is better to sell early and start anew.

However, many people stick with it as a last resort.

We understand the feeling, but the earlier you give up, the more likely you are to be able to sell at a favorable price. Even if the sale price is below the loan amount, so to speak, and you are in an insolvent situation. As long as you have enough time, you will have a better chance of negotiating with your creditors.

In this day and age when corporate bankruptcies are expected to increase, we proactively provide consultation to those who are unable to pay their mortgages and propose solutions which include a sale by appointment.

As real estate professionals, we need to be able to assess the situation objectively as a third-party consultant, and be willing to help our clients. Considering a healthy number of real estate agents also hold financial planning licenses.

In this article, we will explain the current state of bankruptcy and debt consolidation from this perspective.

Is it right to leave a job if there are signs of bankruptcy?

No one would dare think of purchasing a house when there is a possibility that the company they work for will go bankrupt.

There are many people who sense these signs from the atmosphere of the company’s upper management, but don’t take it too seriously. Thinking the company’s upper management will be able to handle the situation.

In fact, many people suddenly learn of their employer’s circumstances in the news and become angry because they did not hear about it directly from their company.

Various signs of bankruptcy can appear prior to bankruptcy, such as late payment of salaries, collection of accounts receivable before the due date, taking orders for work that is clearly unprofitable, extreme cost-cutting measures and personnel cost cutting, frequent visits by lawyers and other professionals, and resignation of senior management.

Those who have knowledge of accounting, you may be able to check the financial statements and understand the situation, but it is not advisable to leave a company prematurely because of a high possibility of bankruptcy.

If there are unpaid wages, the Labor Standards Inspection Office will pay up to 80% of the unpaid wages, with a maximum of 2.96 million yen, under the Replacement System.

Those who resigned, will be considered to have “resigned for personal reasons,” and unemployment insurance benefits will be restricted to two months after the seven-day waiting period. The maximum benefit period will be 150 days (maximum benefit of 330 days in the case of resignation for company reasons).

In the case of resignation for company reasons, unemployment insurance benefits are paid from 7 days after resignation at the earliest, so there is a big difference.

In addition, 60% of the remaining amount of the re-employment allowance, which is paid to those who find a job early, is paid in a lump sum if the remaining one-third of the benefit period is over.

For those who receives consultation from a client who is “worried about their company,” we should advise the client not to rush to resign for personal reasons, but to look for a new job while making every effort to avoid bankruptcy.

However, the amount of unemployment insurance benefits is calculated as “number of days of benefits x daily basic allowance,” and the maximum daily wage and maximum daily basic allowance (e.g., 8,355 yen/day for 45-49 year olds) are set respectively. Therefore it is unlikely that many people can maintain their life style up to that point on unemployment insurance benefits alone.

The amount of such benefits may be one of the reasons why an increasing number of people are looking for new employment after their employer goes bankrupt and are unable to find new employment. Or are considering personal rehabilitation or bankruptcy if they have a mortgage and or other debts.

There are few disadvantages to personal bankruptcy, but not if you own real estate.

As real estate agents may know, even if you go bankrupt, your name will appear in the official gazette and you will not be able to borrow money again for 5 to 7 years. Therefore your daily life may not be affected all that much.

However, if you own real estate or other assets, they will be sold at auction.

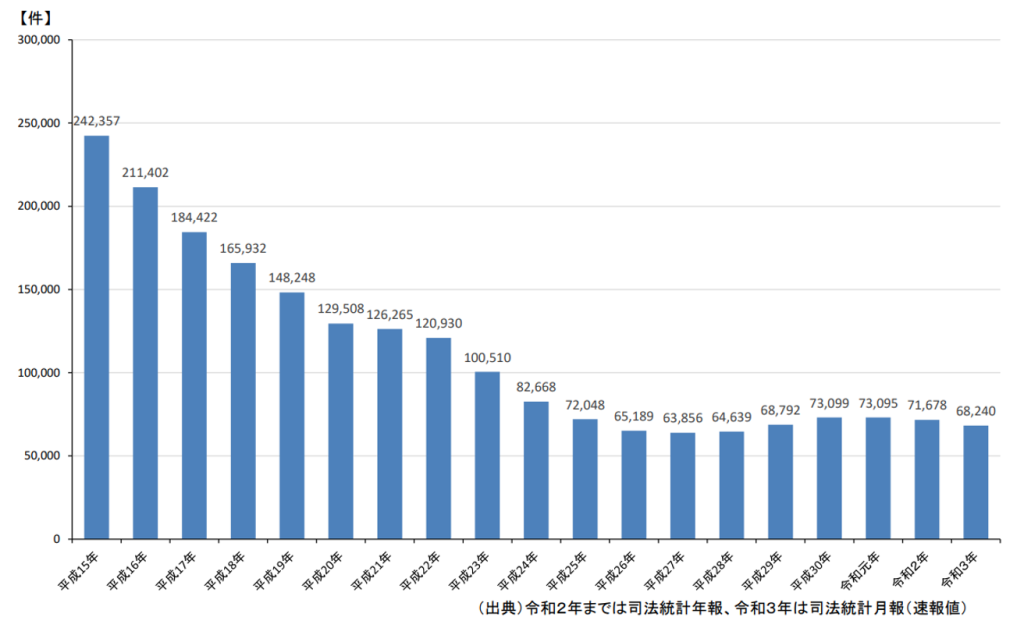

Although the number of auctions is on the decline, it is not because the number of individual debt settlement cases has decreased. This is because the number of sales by appointment is steadily increasing.

If the question is whether auction or voluntary sale is better, it is more advantageous for the parties concerned to choose voluntary sale because the time of vacating the property can be adjusted to some extent and there is a possibility of leaving funds on hand.

An auction is a form of debt restructuring in which the owner voluntarily negotiates with creditors and sells the real estate to repay debts. Therefore, the purpose of an annexation sale is different from that of debt restructuring through bankruptcy.

According to the “Trends in the Current Situation and Policies Concerning Measures for Multiple Debtors” jointly released by the Financial Services Agency, Consumer Affairs Agency, Ministry of Health, Labor and Welfare, and Ministry of Justice in June 2022, the number of personal bankruptcies has been decreasing since 2003 and has remained flat since 2014.

The decline in the number of bankruptcies is said to be due to government economic policies. Lower interest rates, financial institutions becoming more flexible in revising repayment plans, and an increase in the number of people choosing alternatives to bankruptcy, as knowledge of debt management systems becoming more widespread.

Personal Debt Consolidation: Types to Remember

There are four types of individual debt consolidation: voluntary liquidation, specified mediation, individual rehabilitation, and bankruptcy.

When you consult with a lawyer about debt settlement, voluntary liquidation is often recommended.

The voluntary sale mentioned above is also a part of voluntary liquidation.

Since commercials were aired frequently, voluntary liquidation where lawyers and judicial scriveners intervene and negotiate with creditors by performing a recalculation of interest that exceeds the Interest Rate Restriction Law, is well known.

In the case of judicial scriveners, however, their intervention is limited to legal consultations and lawsuits of 1.4 million yen or less. Individual reorganizations other than overpayment/repayment procedures are the domain of lawyers.

Compared to such high-profile voluntary liquidation, many people do not seem to know about these specified mediations.

Specified Conciliation is a special case of civil mediation under the jurisdiction of the Summary Court.

Like civil conciliation, it is a system in which creditors and debtors hold discussions in court to resolve disputes.

However, the conciliation is conducted by a conciliation committee designated by the court to adjust the interests of the parties, and the parties do not negotiate directly with each other.

The system is characterized by the fact that the conciliation committee acts as a coordinator, so the parties can conduct the mediation on their own without requesting a lawyer, judicial scrivener, or the like.

The purpose of the negotiation is to recalculate the debt and cut off future interest, but it is unlikely that interest and damages will be exempt from the scheduled installment payment plan for a mortgage.

(Negotiations are possible, but the likelihood of creditors agreeing to a reduction is said to be extremely low.)

Since these calculations are extremely complicated, it is essential to discuss them with the mortgage company or bank in advance.

The reason why the specific mediation is not well known may be due to its low success rate (generally around 3%).

While there are advantages such as reduced costs without hiring an attorney, there are also disadvantages such as the need to complete complicated paperwork and coordinate litigation schedules on one’s own.

While the purpose of Specified Conciliation is to reduce the amount of future interest and to recalculate the amount of debt, the purpose of Individual Rehabilitation is to reduce (exempt) the principal amount to a maximum of one-tenth.

Upon application to the court, a rehabilitation commissioner appointed by the court listens to the opinions of both the debtor and creditors, and formulates a rehabilitation plan with a minimum repayment amount. If the rehabilitation plan is approved, repayments are made in installments over a period of three years in principle (five years under special circumstances) based on the rehabilitation plan.

This is a revolutionary method that allows the debtor to keep assets such as real estate and cars, but it is said to require hard negotiation. Even though a rehabilitation commissioner will intervene, it is said that having an attorney is essential.

If none of the methods described so far can solve the problem, or if the various conditions are not met, bankruptcy will be considered as a last resort.

Having an understanding of the logic, the method for those who have difficulty in paying their mortgages begins with the consideration of voluntary liquidation, and bankruptcy is the last resort.

Helping those through a Voluntary Sale (short sales)

Although individual debt consolidation was explained in the previous section, basic knowledge is necessary in order to give an explanation in which “such a method exists” when consulted by client. But that does not mean that we real estate agents can be directly involved in such cases.

If we provide “bad” consultations, there is a possibility of being charged as a non-practicing attorney.

The correct stance would be to listen to what the client has to say and, if necessary, refer the client to a specialist.

What we do better than other professionals in the area of personal debt management is the handling of voluntary sales.

The first point of contact between real estate agents and a clients who is considering debt consolidation, except referring to a professional (attorney), is likely to request an appraisal for the sale of a house.

At this time, the client will naturally be asked the reason for the sale, but it is difficult for them to provide this information, “Because I am having difficulty repaying my loan.

It is not surprising, since the client will first want to know the market value of the house, and whether it is possible to sell the house to pay off the mortgage.

However, if the property is to be offered for sale, it is better to do so as soon as possible.

It is natural to perform a preliminary investigation when there is an appraisal request, but when visiting for appraisal, we want to find out about the true intention and the current state of the appraisal request not only by the state of the property but also by the interaction with the customer and their facial expressions.

If a large amount of debt remains after the sale of the property, the seller will have to have sufficient cash to have the lien taken off the title.

If the client has cash on hand, they may be in the early stages and may be able to continue paying the mortgage payments.

What we real estate agents should recommend before making any brass decision, the client should consult with the financial institution where they are borrowing from. This way the lender can discuss with the client and review their payment plan.

Obviously, we cannot give such advice if we do not know the exact reason for the appraisal request.

Often, they are unable to repay their mortgage, and even if they request an appraisal with the intention of selling the house and avoiding the payment, the debt will remain even if the house is sold for the amount offered. However, even if the house is sold for the amount offered, the debt will remain. The borrower is unable to come up with the funds, and in the process becomes delinquent.

The pattern is that you lose the benefit of time and panic when the property is eventually put up for auction.

As a real estate professional, we should provide appropriate advice before such a situation occurs. What is needed for this is the true reason behind the appraisal request.

Rarely will a client bluntly say “I’m having difficulties paying my mortgage.” The trick is in how we ask our clients questions.

There is a psychological resistance for anyone to reveal his or her financial situation to a person whom he or she has never met before.

Although it takes a certain amount of technique and experience to gain trust and draw out the truth in a short period of time, trust can be gained by asking questions in good faith and proposing solutions. As real estate agent, we are obligated to maintain confidentiality.

The Financial Services Agency has issued a notice that “if you are asked to review your repayment plan, you must respond to the request” and your track record to the response is reviewed in audits. Therefore, there is no financial institution that will not respond to requests for consultation, whether or not they are willing to review it.

However, even if the repayment plan is reviewed, there is no guarantee that payments can be made as planned if the income is unstable due to leaving or changing jobs, as explained at the beginning of this article.

In such cases, the best solution is to sell off the property and pay off the mortgage.

However, a sudden proposal to sell the property because the client is having trouble paying the mortgage will not be accepted or taken warmly.

It is a step-by-step process to find a solution, and the final step is to sell the property.

Unfortunately, not many people are able to recover on their own once they fall into financial difficulties.

Especially if the debtor has lost the benefit of time due to delinquent payments, it is not possible to revise the repayment plan itself.

In such cases, we help the debtor to negotiate with financial institutions and services to sell the property under more favorable conditions while supporting the debtor by having the debtor declare a sale of the property. In other words, a voluntary sale is a way to help those in these circumstances.

In these uncertain times, it is the role of a real estate agent to be close to the consumer and provide appropriate advice according to their situations.

It is important to be prepared to actively listen, and also learn the necessary skills and put them to use.

Summary

We have focused on personal debt restructuring in order to provide appropriate counseling to employees who are affected by the expected increase in corporate bankruptcies and to those who are in financial difficulties.

We as real estate agents, can only be actively involved in the cancellation of debts through the sale of real estate.

For other methods, it is necessary to ask for the cooperation of a specialist and professional according to such cases.

However, even when negotiating a sale with a financial institution, the other party is a professional debt collector.

If we consult with them, they will handle things in a straightforward, administrative manner, but there is no room for amateurs to take advantage of this.

In order to negotiate more favorably, we need various “know-hows”, and naturally you also need the knowledge to back it up.

It is necessary to learn and be aware of and knowledgable of personal bankruptcies cases in order not to be taken lightly by the negotiating party.

Original Article: 【自己破産は増加に転じている?】不動産業者なら覚えておきたい債務整理の知識

For additional information or any questions please contact us here

Email: info@remax-apex.com