Have you heard about the so-called “High Rise Condominium Tax Saving Trial”, the Supreme Court’s decision on April 19, 2022, which has attracted a lot of attention in the real estate industry.

This case involved a dispute between a taxpayer and the national tax authorities regarding inheritance tax measures taken under the scheme “purchase a tower condominium in cash or by borrowing on purpose to avoid inheritance tax.

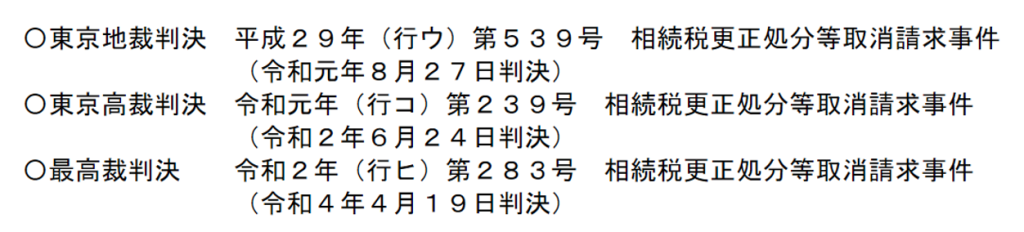

In this case, the taxpayers lost in the district court, the high court, and the Supreme Court. In other words, the purchase of tower condominiums for the purpose of tax-saving measures was deemed unacceptable if taken to an excessive degree.

The valuation of real estate at the time of inheritance is calculated by multiplying the area of land by the roadside land price or by the multiplier method after making various corrections such as the depth price correction rate. For buildings, it is calculated by multiplying the assessed value of fixed assets by 1.0.

For land valuation in condominiums, after the valuation of the entire site is calculated, it is divided proportionally by the percentage of ownership of the unit owners.

For high rises however, the floor-area ratio is used up to the upper limit, and the high number of units are secured by stacking the stories, therefore the evaluation after prorating the land is kept low.

In addition, if the property is operated as a rental property, valuation can be further reduced by using valuation reduction factors such as the percentage of leasehold and the percentage of the property built for rent.

In contrast, the market value of an 80-square-meter building in Sapporo, is 200 million yen if the conditions are good in the city center, and over 300 million yen is not uncommon in the three major metropolitan areas if the location and age of the building are appropriate.

Since such market value can be significantly reduced in the assessed value for inheritance tax purposes, wealthy individuals who are likely to face high inheritance taxes can purchase high rise condominiums using cash on hand or loans from financial institutions, thereby reducing the amount of inheritance taxes at once.

Not all of these tax-saving measures are considered problematic, but they are still a matter of degree.

If it is too much from the viewpoint of fairness of tax burden, it will be pointed out, and above all, the tax office will not keep quiet about it. This is because of the “Basic Notice on Property Valuation, Paragraph 6,” which can be called the family heirloom by tax law.

In this article, we will explain the impact of this precedent on the future, as well as the aforementioned “High Rise Tax Saving Trial”.

Basic Notice of Property Valuation and the High Rise Trial Summary

The so-called “Basic Notification on Property Valuation” was issued by the Commissioner of the National Tax Agency to the Director-General of the National Tax Administration Bureau, instructing on a wide range of valuation standards, including general rules, principles of valuation, co-ownership, classification, actual property, thus property valuations can be performed correctly.

The basic notice dates back to April 25, 1964, and has since been revised many times in accordance with the times.

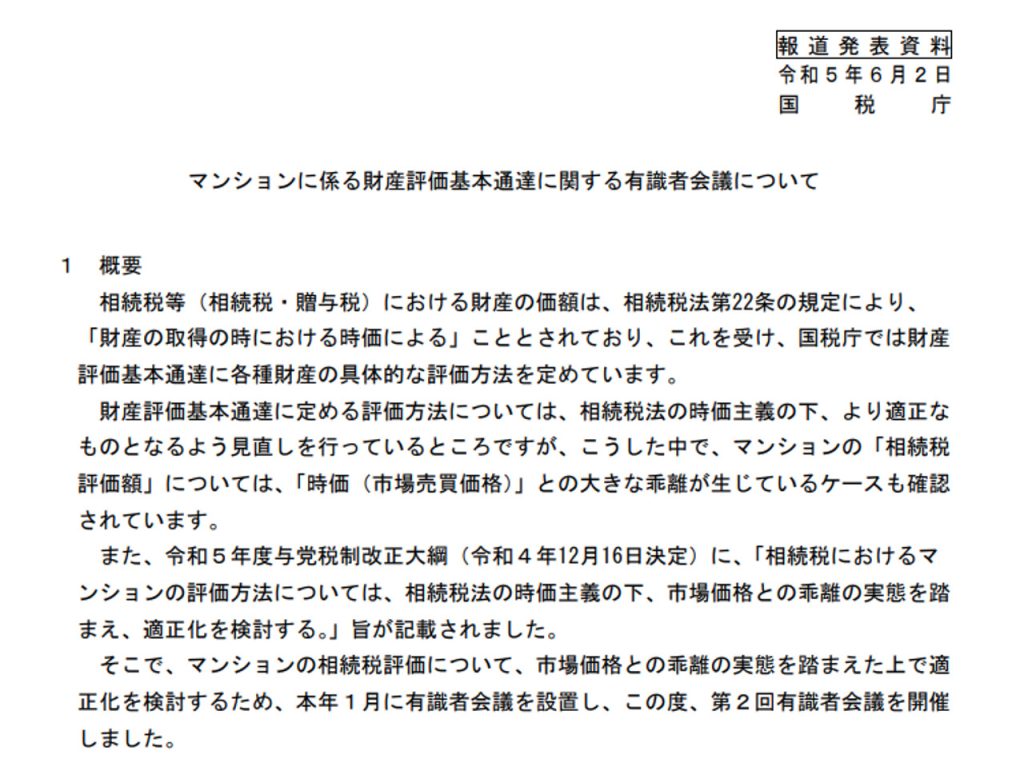

In principle, the valuation of property for inheritance tax purposes is based on market value.

However, market values change with the times. Therefore, the circuit defines market value as “the value that is usually considered to be established when free transactions are conducted between an unspecified number of parties,” and defines specific valuation methods.

According to this notice for condominiums, the assessed value of the building portion is divided proportionally based on the ratio of the total floor area of each individual unit, and for land, the assessed value of the entire site is calculated and then divided proportionally based on the ownership ratio of the unit owners.

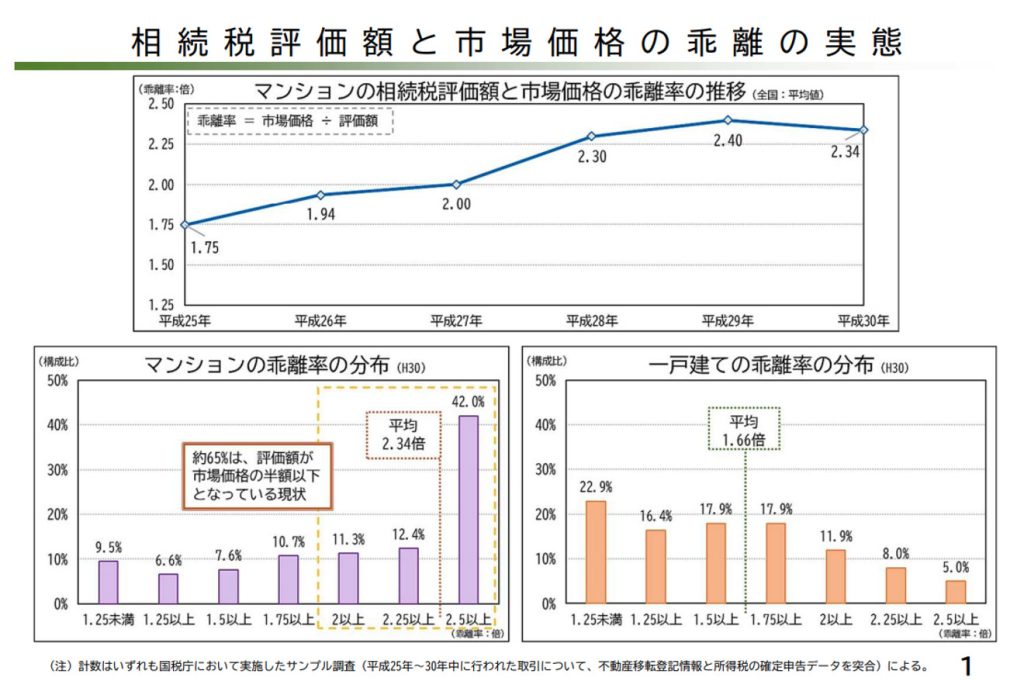

Although the tax reform in 2017 made it possible for condominiums built after 2018 with 20 or more floors to be prorated at a higher ratio for higher floors, there is still a large gap between the market value and the inheritance tax valuation of high rise condominiums on the upper floors, of which are well located, with good views, and natural sunlight.

If debt is created by financing the purchase, the debt portion of the outstanding loan is a deductible item and can be deducted from the taxable value of the estate.

The following two inherited properties were targeted in the aforementioned “High Rise Tax Saving Trial”.

Property A: 837 million yen (acquired in January 2009, loan amount 630 million yen)

Property B: 550 million yen (acquired in December 2009; loan amount: 425 million yen)

The total purchase price is 1.387 billion yen.

Both of these properties are newer buildings near stations in the Tokyo metropolitan area. Although there is no specific mention of the properties in the judgment, it is assumed that they are both high rise condominiums, taking into account the floor area ratio digestion rate.

Furthermore, the properties were acquired as investment properties for the purpose of rental operation.

When the inheritance began, the heirs valued the properties in accordance with the Basic Notice on Property Valuation, and the assessed value of the property (inheritance) was 519 million yen against the total purchase price of 1.387 billion yen.

The total debt is 1.055 billion yen, but it has not been reduced by much.

In other words, if you deduct debts, etc., the inheritance tax would be “0”.

In fact, the heirs filed a tax return to that effect.

The tax office requested a real estate appraiser to evaluate the property, because it was considered to be problematic from the viewpoint of fairness in taxation.

Based on the appraisal results, the tax office calculated the market value to be 888,749,000 yen.

The difference from the declared market value is approximately ¥370 million.

If the inheritance tax is recalculated assuming this to be the market value, the amount of tax to be paid would be 240,498,600 yen instead of “0,” which is the amount declared by the heirs.

Therefore, the taxation authority issued a correction to increase the amount of inheritance tax.

The heirs were happy that their inheritance tax had been reduced to “0” through tax-saving measures, but after the correction they were required to pay 240 million yen in taxes due to the increased correction.

The heirs refused to remain silent, as the calculation was based on the results of the calculations stipulated in the Basic Notice of Property Valuation.

They appealed the decision to the National Tax Tribunal, but the appeal was not approved, thus the heirs decided to file a lawsuit.

The Fact that the Inheritance Tax Law does not provide for a Market Value method

Article 22 of the Inheritance Tax Law stipulates that “the value of assets acquired by inheritance, bequest or gift shall be based on its market value at the time of acquisition.”

However, the Inheritance Tax Law does not specify a specific method for calculating market value.

You may think, “Hey, isn’t the roadside land price used for land and the fixed asset valuation used for buildings? Correct, however that is not the law. It is a calculation method based on the aforementioned “Basic Notice on Property Valuation.

The Commissioner of the National Tax Agency originally issued these instructions to the National Tax Administration Bureau, tax bureaus, tax offices, and other related organizations, and the tax authorities basically to follow the instructions.

Our knowledge of fair market value for inheritance tax purposes is also based on this notice.

Although not generally known to the public, the official website of the National Tax Agency has a page titled “Notices of Interpretation of Laws and Regulations,” where you can find notices of laws and regulations divided by item, including those related to income tax, inheritance tax, gift tax, and appeals.

If you actually visit the site, you will see how frequently the inheritance tax law is revised.

Knowing the reality that the notices have been revised so frequently, it is easy to understand how much thought has gone into ensuring that there are no omissions in the interpretation of the valuation standards and application of tax laws for the purpose of collecting taxes.

The market value of the property was calculated by the plaintiffs in the “High Rise Tax Saving Trial.” The plaintiffs in the “High Rise tax reduction trial” calculated the market value of their property in accordance with the Basic Notice on Property Valuation, which is technically not wrong.

However, if there is a significant discrepancy between the actual market value and the assessed value for inheritance tax purposes, the Commissioner of the National Tax Agency may give instructions on the valuation in accordance with Paragraph 6 of the same circuit.

Paragraph 6 states in full: “The value of property for which it is deemed extremely inappropriate to be assessed in accordance with the provisions of this circuit shall be assessed in accordance with the instructions of the Commissioner of the National Tax Administration Agency.”

In the end, the “High Rise Tax Reduction Trial” was a case in which the tax office used Paragraph 6 of the Basic Notification on Property Valuation to dispute the legality of the market value calculated by the tax office.

Will Supreme Court Decision Deter High Rise Purchases as Inheritance Tax Prevention?

In the “High Rise Tax Reduction Trial,” the plaintiffs appealed to the District Court against the decision of the National Tax Appeals to dismiss their claim for review.

In other words, the National Tax Bureau won the case.

As you know, a single precedent does not have legal force or legal norm, but it does have “pre-existing jurisdiction” under the Code of Civil Procedure, even if it is not a “source of law” which serves as a standard for universal application of said law.

So much so that a ruling by the Supreme Court will have an impact on analogous interpretations as well as expansions and reductions, which will bring an end to the “buy a high rise condo to save on taxes” scheme.

To avoid misunderstanding, this does not mean that all tax-saving schemes using real estate will cease to be valid.

In the “High Rise Tax Saving Trial,” the court first stated, “In order to realize the general principle of equality in taxation, it is required to ‘treat like things in the same way,’ and the valuation notice is provided as a uniform valuation method for this purpose. Therefore, it is illegal for the national tax authorities to adopt a method other than the Notice of Assessment only for the calculation of certain persons, in violation of the principle of equality, unless there are reasonable grounds for doing so.”

With that being said, it is illegal to make paragraph 6 apply only to certain individuals.

However, the court also accepted the application of Paragraph 6 on the grounds that the series of acts by the plaintiff and the decedent were carried out with the expectation of reducing or avoiding the burden of inheritance tax. If the court allowed this, it would cause an unacceptable imbalance between the plaintiff and other taxpayers, which would be contrary to the fairness of substantial tax burdens.

Since the court has already ruled that the taxpayer’s taxable income is “illegal,” the National Tax Administration will not be able to easily pull out its trump card.

The IRS moved swiftly in response to this ruling.

In order to prevent the IRS from pulling out its trump card, the IRS should change the calculation method of property valuation so that it is more realistic.

In fact, the National Tax Agency has held a meeting of experts to discuss a standard method of property valuation which is in line with the actual cases, as there is a large discrepancy between the inheritance tax assessed value of condominiums and the market value.

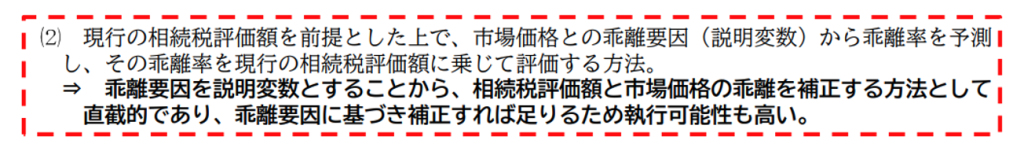

From the publicly available summary of the meeting, it seems likely the current inheritance tax assessed value of high rise condominiums will be multiplied by a deviation rate which uses the deviation factor as an explanatory variable.

However, even if the discrepancy rate is used, discussions are still ongoing regarding the specific scope of application. How to define the cumulative total, and whether it should be used for other property as well, so the revision will not be immediate.

It is generally expected the calculation method of inheritance tax assessment will be revised as early as January 2024, or the year following at the latest.

Summary

Not all tax-saving measures using real estate have been ruled out.

They are still effective as long as they are not overt.

However, it would be better to avoid explaining “purchasing a high rise condominium is a good inheritance tax measure” without understanding the precedents explained in this article.

The reason is that in the near future, the deviation rate will be adopted, and it is highly possible the tax-saving effect will not be as great as explained.

For the time being, it will be necessary to keep a close watch on the developments of the expert panel and the IRS.

Original Article: 【タワーマンションを購入して相続対策しましょうは通用しない?】正しく理解しておきたいタワマン節税裁判の概要

For additional information or any questions please contact us here

Email: info@remax-apex.com