Explained, Including Differences from New Condominiums

With the continued rise in new condominium prices, interest in pre-owned condominiums is growing. Many people are considering buying a more affordable pre-owned condo and then remodeling or renovating it to suit their preferences.

In this article, we’ll explore key points and tips for choosing a pre-owned condominium that retains its asset value.

1. Are More People Considering Pre-Owned Condominiums Instead of New Ones?

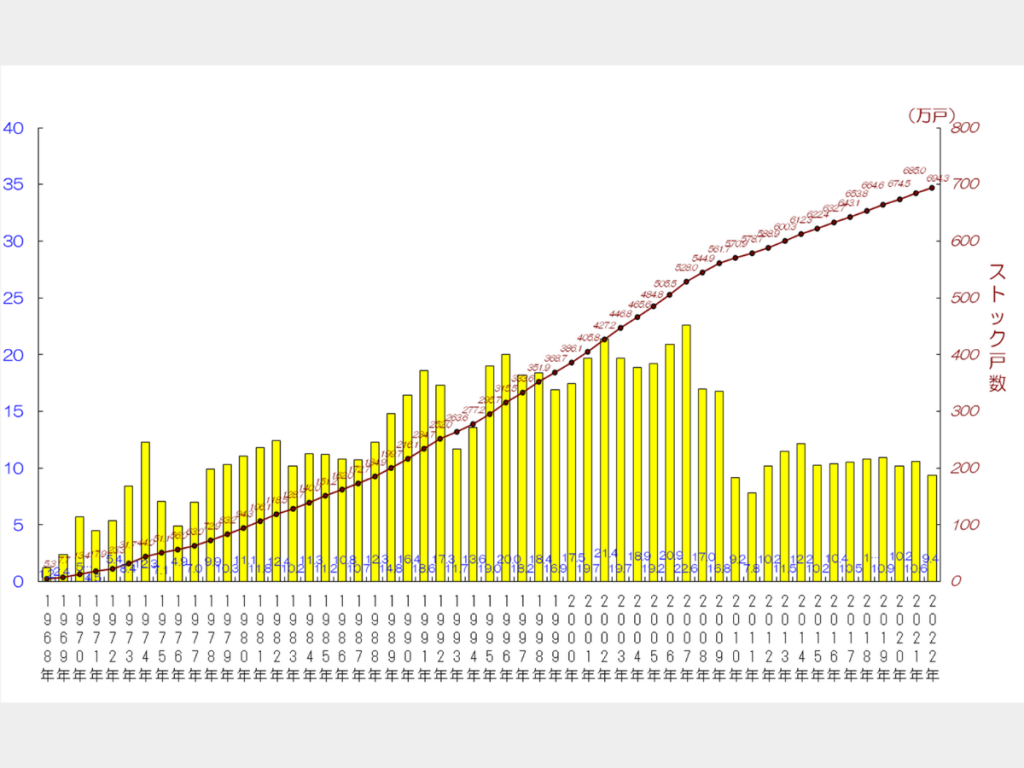

To begin, let’s take a look at the trends in sales volumes for new and pre-owned condominiums.

The supply of new condominiums dropped significantly following the 2008 Lehman Shock. After hitting a low point in 2011, the year of the Great East Japan Earthquake, there was some recovery; however, the supply of new condominiums has since remained relatively stagnant at a low level.

Compared to 2007, when more than 200,000 units were supplied, the number of new condominiums in 2022 was approximately 94,000—less than half.

With this decrease in new condominium supply, there’s no guarantee that new properties will be available in your desired area. Expanding your search to include pre-owned condominiums may increase your chances of finding a property that meets your needs.

In the past, new properties were considered more popular in Japan than in Western countries. However, the number of transactions for pre-owned condominiums has increased compared to 20 years ago.

With condominium prices continuing to rise for both new and pre-owned properties, it’s essential to understand market trends to avoid overpaying.

In the following sections, we’ll discuss what makes a condominium retain high asset value and provide specific tips on how to choose a pre-owned condominium that won’t lose its value.

2. What Defines a High-Value Pre-Owned Condominium?

Before explaining how to choose a pre-owned condominium that retains its asset value, let’s first clarify what we mean by “asset value.”

A “high-value condominium” refers to a property that can be sold or rented without incurring a loss. Specifically, this means:

- You can cover the remaining loan balance with the sale price of the property.

- If rented out, you can lease it for an amount that exceeds the monthly loan payments.

In other words, a property that can be sold or rented at a fair price relative to the outstanding loan balance is considered to have asset value. For high-value condominiums, the owner may retain hundreds of thousands to millions of yen after selling. Not only does this mean effectively living rent-free for many years, but it also brings in returns upon selling—quite impressive!

On the other hand, with a low-value condominium, selling your home may not fully cover the remaining loan, leading to financial difficulties.

While many people buy homes with the intention of staying there for life, unexpected events can happen. Life changes such as family expansion, job changes, or relocation may require you to consider selling or renting out your property. Owning a home with strong asset value can provide security in such situations.

So, how do you find a high-value condominium? Let’s go over key points to check when purchasing a pre-owned condominium with solid asset value.

3. How to Choose a Pre-Owned Condominium That Retains Its Asset Value

Next, we’ll introduce four key points for choosing a pre-owned condominium that retains its asset value.

Understand the Pricing of Pre-Owned Condominiums

The most important factor when purchasing a pre-owned condominium is understanding the pricing and market trends before making your decision.

To avoid losing money when buying a home, it’s crucial to purchase at the lowest possible price. While it’s difficult to find a bargain, the goal should be to buy at a fair market price and avoid overpaying for a property. If you buy a property that’s priced above the current market value, you’ll be at a loss from the start, as you’ll be paying more than the property is worth.

The price of pre-owned condominiums is mainly determined using a method called the “Comparable Sales Approach” (取引事例法). This method assesses the price based on similar past transactions, meaning that the price derived through this approach is considered the market price.

Of course, when pricing new condominiums, surrounding market conditions are also considered, but due to advertising costs and the premium placed on new properties, new condominiums are typically priced higher than the market value. It’s often said in the real estate industry that a new property loses 10-20% of its value as soon as it’s lived in. Therefore, new condominiums are best suited for those who prefer living in a brand-new home, even if it means paying a bit more.

In contrast, pre-owned condominiums are ideal for those who prioritize cost performance. You can purchase a property with similar features for a lower price compared to a new one. Since the price is aligned with the current market, the value of the property is less likely to drop when reselling.

When assessing the market price, it’s useful to refer to the prices of other pre-owned condominiums currently on the market in the area. In many cases, the actual sale price is about 10% lower than the listing price on websites like SUUMO or Homes.

Location is the Most Important Factor

Whether new or pre-owned, the location is the most significant factor influencing a condominium’s asset value.

Condominiums tend to be favored by those who prioritize convenience, with factors like “proximity to the station” and “closeness to the city center” being highly valued.

For condominium buyers also showed a strong tendency to prioritize location. When asked, “What is more important than the seller or brand?” about 80% of respondents ranked “location (address)” as the most important factor.

When selecting a condominium with an emphasis on asset value, location is a key point that cannot be overlooked.

Price Differences Based on Age of the Property

The age of the property is also an important factor when purchasing a pre-owned condominium. Many people may have thought that condominium prices tend to drop immediately after moving in. However, in recent years, with rising market prices, properties that are less than 10 years old have largely not depreciated.

For those planning to move within a short term (around 10 years), choosing a relatively new property will make it easier to sell when it’s time to move.

Check the Management Condition

When considering older properties, concerns about the condominium’s lifespan and safety are natural.

Recently, some condominiums are marketed as “100-year condominiums,” promoting the idea that they can be lived in for a long period. However, the legal useful life of a condominium is considered to be 47 years.

The legal useful life is simply a tax guideline, so it is possible to continue living in a property even after 47 years have passed. While the useful life and lifespan of a condominium differ, many may wonder what happens to a condominium that is nearly 50 years old.

Even if the building was constructed with a solid structure, proper management is essential to ensure that the property remains safe and well-maintained for continued habitation.

There is a saying, “You are buying the management when you buy a condominium!” The management condition of a condominium is directly linked to its livability.

It’s easy to check whether the exterior walls and landscaping are well-maintained, or if shared spaces such as the mail area and garbage disposal site are kept clean. These are simple but important points to verify during a property viewing.

Additionally, if requested, you may be able to view the minutes from the homeowners’ association meetings or the long-term repair plans. Be sure to check if documents are properly stored and if there are any arrears in residents’ maintenance fees.

4. Summary

This article has introduced how to choose a pre-owned condominium that maintains its asset value.

How to Choose a Pre-owned Condominium with Stable Asset Value:

- Understand the price market for pre-owned condominiums

- Prioritize location

- Understand price differences based on the age of the property

- Check the management condition

When selecting a home with an emphasis on asset value, checking for fair pricing is essential.

For additional information or any questions please contact us here

Email: info@remax-apex.com