Original Article: 【相続不動産に関しての相談が増加傾向にあるからこそ覚えておきたい】法定相続情報証明制度について

With the mandatory inheritance registration coming next year, the number of real estate consultations regarding inheritance has increased dramatically.

While it is common for people to bring their legal opinions on the division of property to lawyers and the like, the handling of real estate due to inheritance can be a specialized field for us real estate agents.

However, even if we are skilled in the buying and selling of real estate, we are not experts in inheritance-related legal procedures, which are asked in rapid succession, and if we give an uncertain explanation, we will not only lose credibility, but also can face trouble down the road.

However, if you are afraid of that and say, “I am not an expert on inheritance, so please contact me at ……,” you will lose out to the competition.

In practice, many people may refer to a professional as necessary, while researching inheritance-related laws on a case-by-case basis.

Especially troublesome in cases where an heir dies without transferring ownership and there is an inheritance by descent, the task of gathering family registers can be troublesome.

Family registers are required for each inheritance division agreement and change of ownership of various types of property.

They will be returned after the procedure is completed, but not immediately.

If the family register is located in a remote area, it takes time to obtain it, and it is also difficult to prepare it immediately when the required number of copies are missing.

The Legal Inheritance Information Certification System can solve such complaints and problems.

The system itself has been in operation since May 29, 2017, but strangely enough, this convenient system has not attracted much attention thus far, and not many people in the general public or even real estate agents know about it.

However, it has suddenly come into the limelight with the impending introduction of mandatory inheritance registration.

In this blog, we would like to explain the “Legal Inheritance Information Certification System,” for which we can assure you that you will be grateful even if we only tell you about the system.

What is the Legal Inheritance Information Certification System?

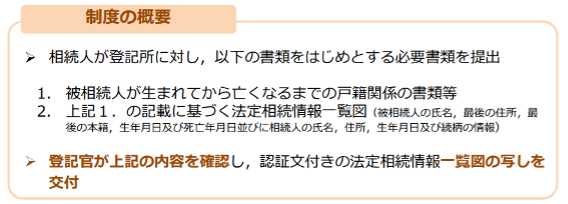

In this system, a person submits a list of inheritance relations (a list of inheritance relations) at the same time as submitting a copy of their family register to the Legal Affairs Bureau, and the registrar will check the list and issue the required number of copies free of charge with a certified statement.

By using a copy with this certification (a list of inheritance relations), it is no longer necessary to submit a copy of the family register for the following procedures.

- Change of the name of real estate in the name of the decedent (inheritance registration)

- Refund (cancellation) of deposits in the decedent’s name

- Change of ownership of securities such as stocks in the decedent’s name

- Change of title to automobiles in the decedent’s name

- Procedures for various pensions arising from the decedent’s death

Since the purpose of this system is to reduce the burden of inheritance procedures by simplifying the procedures and ensuring they are carried out correctly, the scope of the availability of the Inheritance Relation List will continue to expand.

It is a system that is not only worth remembering, but also a waste not to use.

Using the system is easy

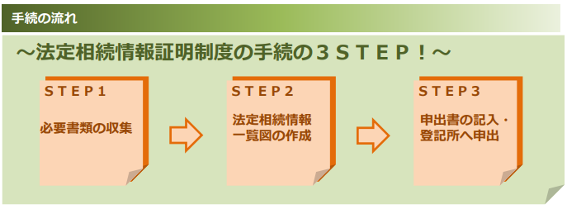

Using the system is not that difficult.

Basically, it is completed in three steps as follows;

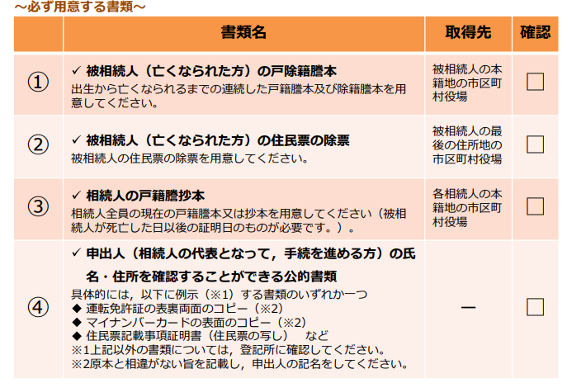

The basic documents required are a copy of the family register and certificate of residence of the decedent (the deceased), a copy of the family register of the heir (the heir to the estate), a copy of the front and back of identification documents (driver’s license, my number card, etc.) of the person applying for the system, and a chart of inheritance relations.

In other cases, a certificate of residence, an attorney’s letter, or a copy of the decedent’s family register may also be required as necessary.

However, it is advisable to confirm in advance whether or not this is necessary.

The filing address is the legal affairs bureau with jurisdiction over the decedent’s domicile at the time of death, the last place of residence, the address of the applicant, and the location of the real estate in the decedent’s name, so there is no need to worry about it.

The most troublesome part is the inheritance list, but you can obtain the form and example of the document from the official website of the Legal Affairs Bureau available at the URL below.

https://houmukyoku.moj.go.jp/homu/page7_000013.html

When preparing the document, it is important to keep in mind the address of the heirs should be listed.

Although, this is considered optional and does not need to be included.

However, it is convenient for the application at the time of inheritance registration and the procedure for requesting a certificate of testamentary information to be issued, as it eliminates the need to submit a certificate of residence for each heir again.

Unless there is a special reason not to do so, we recommend that the address be listed.

Creating an inheritance list is not difficult

Forms for the application form and the inheritance list can be obtained from the official website of the Legal Affairs Bureau in Word or Excel format.

You can also download the forms and fill in examples in PDF format, so you may be able to fill in the declaration form without much trouble.

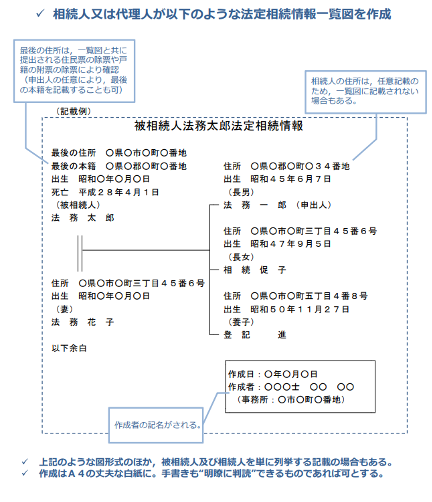

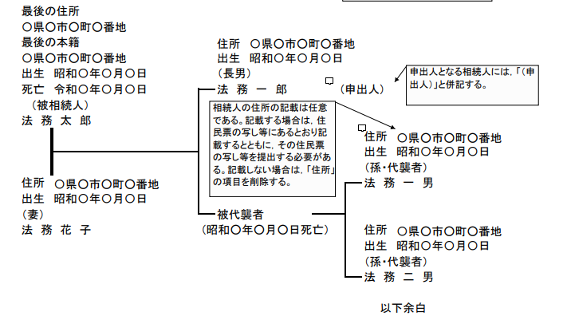

However, it is the inheritance relations chart that can be confusing. The example provided from the Legal Affairs Bureau looks similarly to a family tree.

But it is not difficult. In fact, if you select and download the form that corresponds to the number of heirs (spouse, 3 children, etc.), you can open the following page in EXCEL format.

Simply fill in the input fields marked in yellow.

As mentioned earlier, it is not necessary to enter the address, but it is better to do so in consideration of the time and effort that will be required at a later date (however, it is necessary to enter the address as shown on the residence certificate), and it is necessary to correctly describe the decedent and heirs.

If they are relatively easy to understand, such as wife, eldest son, eldest daughter, adopted child, etc., you may not have to worry, but if there is an inheritance “by descent,” many people may wonder how to describe it.

In fact, when the original author consults on inheritance and recommends the use of the “Legal Succession Information Certification System,” the most common question asked is how to describe this inheritance by succession.

A succession by descent is a situation in which a person who inherited from the decedent has passed away and further inheritance has occurred.

In this case, the heir’s “child” or other “descendant” becomes the heir, but even though he is a “child” to the heir, he is a “grandchild” to the decedent.

Do not mistakenly write “eldest son” or the like.

If you pay attention to these points, you will not have to worry so much about documentation.

Can be reissued if there are not enough copies

On the application form, there is a column to indicate the number of copies of the inheritance list of which are required.

Copies are free of charge, so it is best to indicate the number of copies you need plus a little extra, but there may be times when you run short of copies against.

In such cases, it is possible for the Legal Affairs Bureau to reissue copies.

However, the reissuance is limited to 5 years from the date of application, and only the person whose name is written as the “original applicant” can apply for the reissuance.

When this as a precaution was explained, I was asked, “If the person who filed the application passes away, can he/she be reissued?” I was once asked, “Can’t it be reissued if the applicant dies?

It is a matter of course, but it cannot be reissued.

When an heir dies, his/her “children” or other heirs inherit by succession.

In other words, there is a change in the inheritance list.

Naturally, in such a situation, the contents of the Inheritance Relation Chart are not correct.

A new application will be required.

Providing information is not a problem, but creating a proxy is strictly prohibited

In the wake of the impending introduction of mandatory inheritance registration, consultation on inheritance has increased dramatically.

If you are a real estate agent who has read this article up to this point, you will probably be able to prepare a series of documents, including a list of inheritance relations, without much difficulty.

However, you should not casually act as an agent for filing procedures, including the preparation of the documents.

This is because the qualified agents who can act on your client’s behalf are limited to lawyers, judicial scriveners, land and house investigators, certified tax accountants, labor and social security attorneys, patent attorneys, maritime attorneys, and administrative scriveners.

Of course, if you hold these qualifications there isn’t an issue, but there are not so many who do.

If your qualification is a real estate-related qualification, such as a real estate transaction attorney or chief administrator, you cannot act as a representative even if you have knowledge of the system.

Conclusion

In this blog, we explained the legal inheritance information certification system as knowledge that is guaranteed to earn you compliments when you consult with clients on inheritance matters.

This system helps to simplify procedures and reduce burdens, and is essential knowledge for those involved in inheritance-related real estate transactions.

As you can see from the article, the application is very simple compared to the convenience of the system.

With just this simple procedure, you can obtain a free legal inheritance information chart, which can be used as a necessary document when filing inheritance tax returns, or as a substitute for the family register when filing various pension procedures (survivor’s pension, unpaid pension, lump-sum payment, etc.) due to the decedent’s death.

Furthermore, there is no charge for obtaining a legal inheritance information list (copy). The fee for obtaining a copy and a copy of the family register is currently 450 yen per copy, albeit a small amount.

If you obtain them for each procedure, the cost is not ridiculous.

If there are many heirs, such as multiple heirs with descendants, the cost is even higher, and the documents proving the family register relationship alone would be a bundle.

Since it only takes about one A4 sheet of paper, this service should be used.

In order to handle inheritance-related real estate without causing problems, it is necessary to have extensive knowledge of inheritance tax and registration procedures due to inheritance, in addition to simple knowledge of sales and purchase.

Laws are frequently revised, so there is no end to the learning curve.

However, it is important to understand that knowledge is cumulative, and it is necessary to learn one thing at a time.

For additional information or any questions please contact us here

Email: info@remax-apex.com