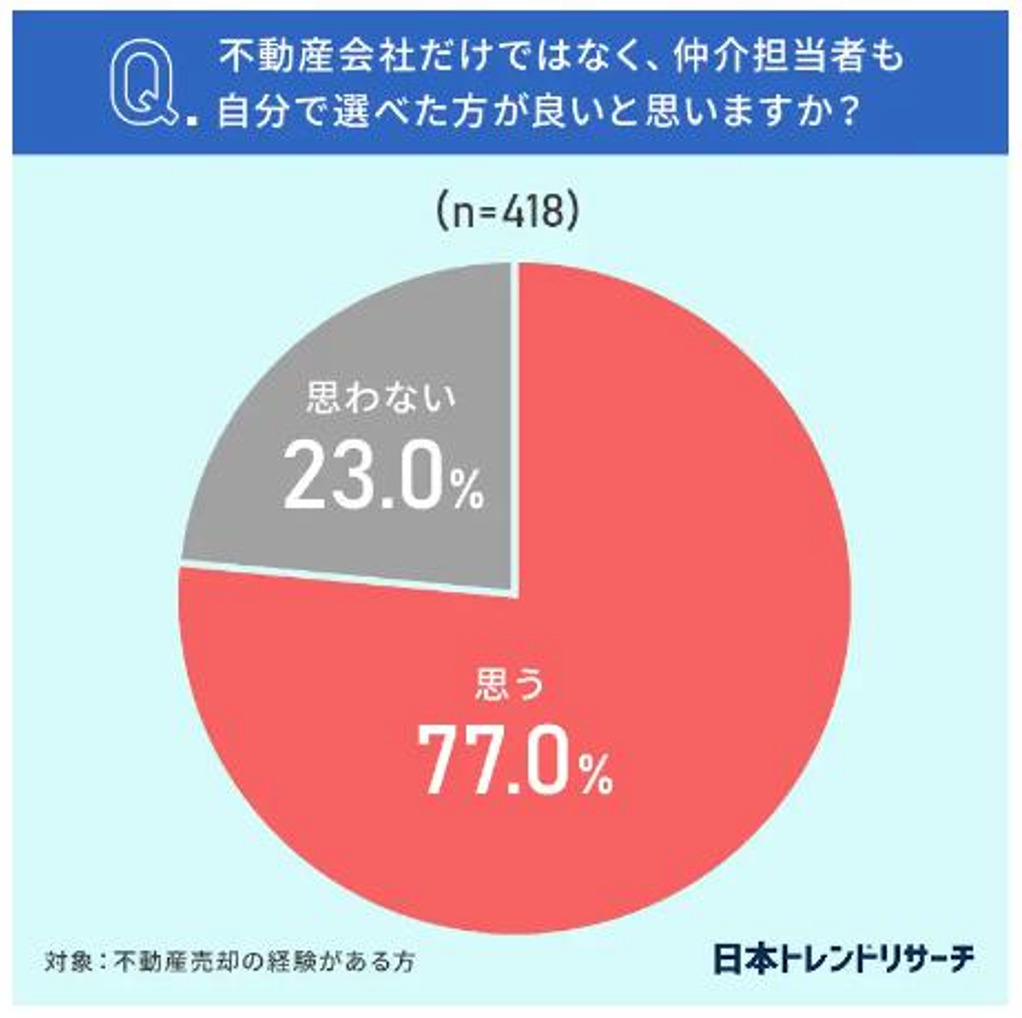

According to a survey conducted by Japan Trend Research in collaboration with Mitsubishi Jisho Real Estate Service, which operates the real estate agent matching service “Taxier,” 77% of those who have sold real estate indicated they wanted to choose not only the company but also the agent as well.

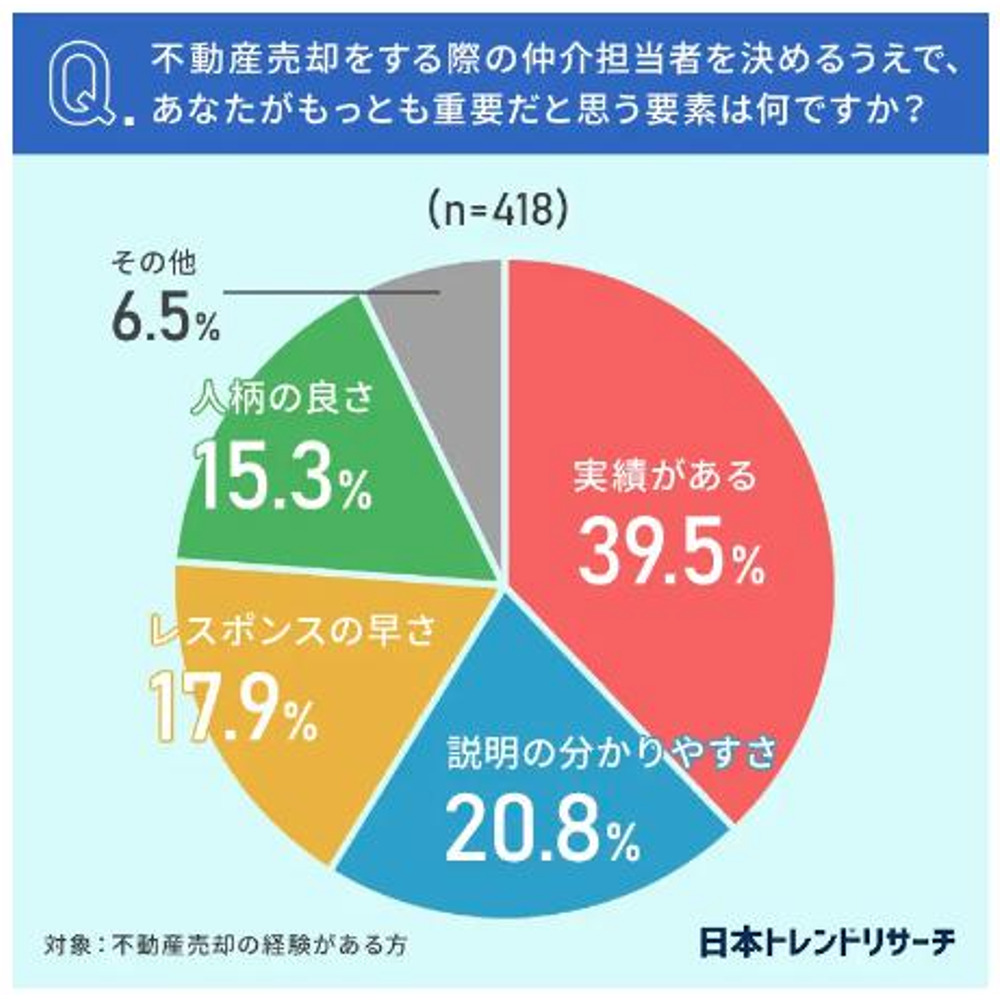

The survey asked respondents which factors they look for in an agent when selling real estate.

As a result, “track record,” “clarity of explanation,” and “speed of response” were at the top of the list, totaling 78.2%.

As mentioned earlier, the questionnaire was administered to those who have experience selling real estate, therefore it can be considered an ability that is required of salespeople.

What is being sought is not just limited to real estate sales, but is an element of a person who can do the job. The more capable a person is at work, the quicker the response.

We can assume agents are busy and we may feel, “There is no such thing as free time.” Even when we have multiple clients and projects we are focused on, those who are “capable,” of the job, they respond promptly to questions and requests from clients and take actions on their own.

In many cases, these types of people are able to use both the traditional and intuitive areas of the analog and the digital areas based on technology to improve their own work efficiency.

For example, when composing an email in response to a customer’s question, ChatGPT can be used to reply in a short period of time.

Generative AI (Generative AI) is effective for improving operational efficiency because it uses a vast amount of open sources to generate original text in a short period of time.

On the other hand, since open sources are used, it is essential to check the authenticity of the generated text.

Even if a plausible response is generated, a closer look reveals that it contains views contrary to laws and regulations and or misleading text. It is necessary to have the appropriate knowledge to instantly recognize these prompts.

In order to practice the “clarity of explanation” demanded by clients, it is impossible to summarize and explain without a deep understanding of the content of the explanation.

In other words, a person who can do his job is a person who is constantly learning.

Well known entrepreneurs worldwide are well-known readers. They emphasize personal growth and knowledge acquisition through reading.

If a salesperson is well educated, knowledgeable, and proficient in the latest DX such as generative AI (i.e., faster processing), it is only natural that he or she will perform well because he or she meets the elements that customers are looking for.

Without knowledge, they will invite trouble which are unnecessary by nature.

In this article, we will introduce legal troubles caused by the lack of knowledge, and at the same time, explain the considerable degree of expertise required of real estate agents.

Sued for Failure to Receive Preferential Tax Treatment under the Special Taxation Measures Law

This is a judgment issued by the Osaka District Court in November 1998.

The case involved a dispute over liability for damages for a contractor’s failure to accurately understand the Special Taxation Measures Law’s preferential treatment for land sales, and the fact that the contractor gave an incorrect explanation, which constituted an illegal act.

Defendant B, a construction company, offered to jointly develop land (927.04 m2) owned by plaintiff A. If the land was jointly developed, it would be subject to the Special Taxation Measures Law.

Defendant B explained that if they jointly developed the land, they would be entitled to preferential treatment as prime residential land development under Article 31-2 of the Special Taxation Measures Law, and if they sold 436.2 m2 of the developed land to the plaintiff, they could reconstruct the house where plaintiff A lived on the site and cover the construction costs of new rental housing without bearing any financial burden.

Plaintiff A believed this explanation and entered into a contract with defendant B for the sale of land for ¥155,560,000 as well as a contract for the construction of a house and a rental house.

The following year, when plaintiff A filed his tax return, the tax office pointed out that he could not receive preferential treatment and would have to pay additional national and local taxes because the land owned did not meet the 500m2 threshold.

Plaintiff A agreed to pay the tax, but at the same time, he was angry with defendant B, stating, “This is not what I was told!” and filed a claim against defendant B for damages equivalent to the amount of national and local taxes.

Since the plaintiff A owned the land for more than 5 years, the transfer tax rate is 20% (15% for income tax and 15% for inhabitant tax).

Although the amount of land acquisition and its circumstances were not clarified, the maximum transfer tax rate would be approximately 21 million yen based only on the sales price.

As defendant B explained, if the preferential treatment as a prime residential land development is applied, the taxable long-term transfer income in excess of 20 million yen would be “2 million yen plus an amount equivalent to 15/100 of the amount obtained by deducting 20 million yen from the said amount of transferred income.”

In other words, “2,000,000 + 1,711,000 = 1,911,000,” which is about 1,900,000 yen less in taxes compared to the main rule of 21,000,000 yen.

This alone does not seem like much of a reduction.

However, when we look at the amount of damages awarded by the court, it appears that the court incorrectly explained the tax burden would be eliminated due to the preferential treatment.

To begin with, in order to qualify for the Special Taxation Measures Law as a project to construct a high-quality building in an urbanization area, the project must meet the requirements of an area of 500 m2 or more in the executed zone.

It is a different story if all the land owned (927.04 m2) is sold, but anyone who does some research will understand that even if 436.2 m2 is divided and sold, it is not subject to the Special Taxation Law.

The court ruled that defendant B is in a position to be trusted by the general public as a person who has a considerable degree of expertise in matters incidental to his/her primary business as a construction business, and therefore has a duty to explain the purpose and applicable requirements of the preferential treatment correctly.

In this case, defendant B was negligent in concluding the contract and was liable to plaintiff A for damages based on tortious behavior.

However, the plaintiff A was also found to be 30% at fault for believing defendant B’s explanation, and the amount of damages awarded was 13.88 million yen.

As mentioned earlier, the amount of damages was based on the amount of tax payment, which leads us to believe that plaintiff A told the courts “the explanation received would eliminate the tax burden due to the preferential treatment.”

However, that is not the important point.

Although tax knowledge is not a field related to the construction business, it is considered “incidental to the business” therefore the duty of the construction company to explain it correctly.

Opinion of Considerable Expertise in Ancillary Matters

Various laws are involved in real estate transactions. This should be clear from the scope of the Real Estate Transaction Examination.

The four basic types of laws are the Civil Code, the Building Lots and Buildings Transaction Business Law, legal restrictions, and other related knowledge, but if you break them down in detail, you must have a broad knowledge of the City Planning Law, Building Standards Law, National Land Use Planning Law, and Agricultural Land Law as well as the Registration Law, Tax Law, Real Estate Appraisal Standards, Land Price Public Notice Law, and statistics.

Although the examinations are designed to prepare candidates, few people can boast they are well versed in each of the laws.

Although being a qualified person is a good indicator, it does not mean that qualification = knowledge.

When you are asked an unexpected question by a client, you may think, “I remember……”

However, as you can see from the previous section, once you respond to a question which is incidental to your business, whether it is about taxation or legal advice on inheritance, you are responsible for what you say.

This is because, from the customer’s point of view, the agent involved in a real estate transaction is considered to have a considerable degree of expertise, regardless of whether or not he or she has a real estate transaction qualification or any other qualification.

We all make mistakes and when you become aware, it is important to promptly apologize and, of course, correct it.

It is especially important not to misstate information which may influence a client’s purchase decision.

(If you repeat “I will contact you later” too often, you will be taken as an agent who knows nothing, therefore it is important to learn on a regular basis.)

Summary

Since the original author is an active real estate agent, he has the same opportunity as everyone else to consult with new clients, and visit clients’ homes for an appraisal.

It is not unusual for several competing companies to exist for consult with said clients, but when explaining the difference between the exclusive right to sell, exclusive, and open list agreements, I am sometimes told, “This is the first time I have heard of this.

When I ask, “Didn’t the last real estate agent explain this information to you? The differences between the listing agreements? He explained, “I did not receive any explanation about the difference between them, I was only pressed to sign a mediation contract.”

There is still a possibility the client won’t understand the details even if he or she is given an explanation. But it is necessary to give correct information while confirming the client’s degree of understanding. I often feel that such a part is omitted.

The role of a real estate agent is to support a safe and secure transactions by building a relationship of trust by providing appropriate advice and information as a professional.

To this end, it is essential to continue to learn and improve one’s professionalism and communication skills.

Original Article: 【知っているフリは厳禁!】業務に付随して有すべき相当程度の専門知識についての見解

For additional information or any questions please contact us here

Email: info@remax-apex.com