Long-Term Care (Nursing) Insurance

Old age = nursing home?

When we think of retirement and living spaces, we imagine nursing homes.

So what is your perception of a nursing home?

“You can’t do anything by yourself, and you can’t do anything without an attendant.” Meals are just served, baths are just wiped, eating, bathing, and sleeping are not something to look forward to, but rather a process.

There aren’t too many people who have a positive perception of “nursing homes.” We suspect there are many people who think like this, those who reject the idea of a nursing home when talked bout. This is due to the fact that people often have a negative image of nursing homes and other facilities.

“If I start to lose my vision, I won’t remember, so you can just let me in anywhere then.”

Some may say the statement above, but is this actually true?

Unlike childcare, long-term care is not a story that ends after a few years.

As written in the last blog of the series 「Retirement Housing, What is the Correct Answer? Vol. 1」the difference between average life expectancy and healthy age is 8.73 years for men and 12.07 years for women. This period of time is the period during which you are taken care of by a caregiver, on average using averages of averages.

For men, they will be under the care of a caregiver for the duration of their elementary and junior high school years combined, and for women, for the duration of their elementary, junior high, and high school years combined.

Considering this, isn’t it right to want to live in a facility where you can spend as much time as possible in comfort?

In reality, however, it seems that in many cases, people choose home care or home-visit care for minor nursing care, and then look for a nursing home when the nursing care becomes severe.

If the nursing care becomes severe, it will be difficult to find a place to live by oneself at that time.

In many cases, children admit their loved ones to a facility of their own choosing, regardless of loved one’s own will.

The current generation of children, our generation (50s and 60s) and the generation below us (40s), are busy with their own lives and do not have time to take care of their parents or to visit many facilities for their parents.

We often end up going straight into facilities that are just light on cost, or facilities that we have been referred to by hospitals or through care managers.

Violence in nursing homes is often reported on TV, but how would you feel if you heard this kind of behavior is happening in the facility you are entering or where your parents are staying?

Let’s take this opportunity to learn about the different types of nursing homes and at what stage of the process it is best to enter which transfer.

But first…

When entering a facility, the type of facility you enter and the cost you pay will differ depending on whether you use long-term care insurance or not.

Let’s learn a little about long-term care insurance.

How Long-Term Care Insurance Works

First, let’s study how long-term care insurance works.

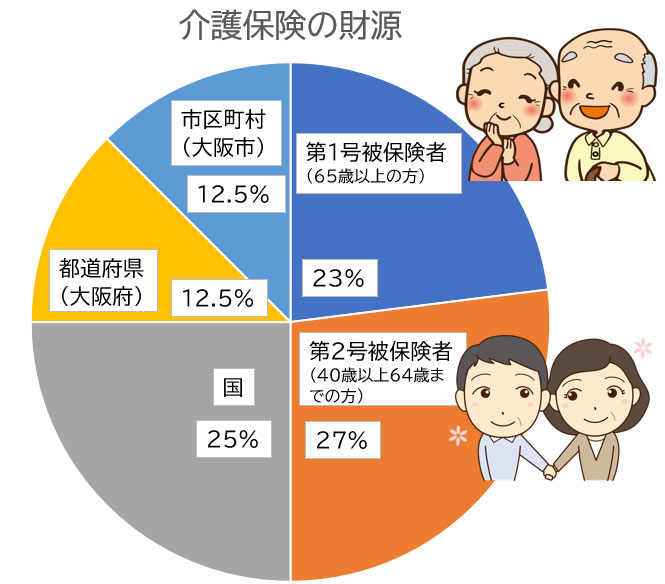

The long-term care insurance system was launched in April 2000 to support people who need long-term care throughout society. The system is funded by insurance premiums collected from citizens aged 40 or older and taxes levied by the national, prefectural, and municipal governments.

People who use long-term care insurance pay 10-30% of the cost, depending on their income.

The public funds pay 50% (25% by the national government, 25% by prefectures, and municipalities), with the Category 1 insured (those aged 65 and over) paying 23% and the Category 2 insured (those aged 40 to 64) paying 27%.

The premiums for those insured under Category 1 vary from municipality to municipality, and are levied according to income, and in principle are deducted from pensions.

The premiums for Category 2 insured persons vary depending on the health insurance they are enrolled in, and are collected together with the premiums for health insurance.

For those who are covered by the health insurance of Union Health Insurance, Health Insurance Association, or Mutual Aid Association, the premium is deducted from the salary according to the monthly standard remuneration, and the employer also pays half of the premium.

Spouses who are covered by health insurance are not required to pay premiums.

For those enrolled in the National Health Insurance system, the long-term care insurance premium rate is calculated based on a unique combination of the four rates (income premium rate, equalization rate, equality rate, and asset rate) for each municipality.

The income premium rate is calculated for each household according to the insured person’s income for the previous year.

In this way, long-term care insurance premiums are collected. Although both Category 1 and Category 2 insured persons are obligated to pay premiums, in principle, only Category 1 insured persons are eligible (beneficiaries) for long-term care insurance.

Category 2 insured persons are covered by long-term care insurance only when they are certified for long-term care due to diseases caused by aging (16 designated diseases).

In order to receive long-term care insurance services

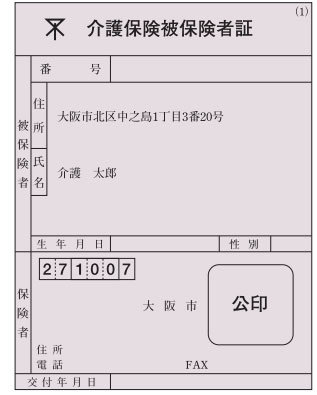

To receive long-term care insurance services, you must be certified as needing long-term care. 65 years of age or older will receive an insured person’s card by mail for each person. Those between the ages of 40 and 64 are usually not issued one.

However, if you have a specified disease, you will be issued a certificate after you are certified for long-term care.

A long-term care insurance card is issued by the municipality in the month of one’s 65th birthday, long-term care insurance services cannot be used without it.

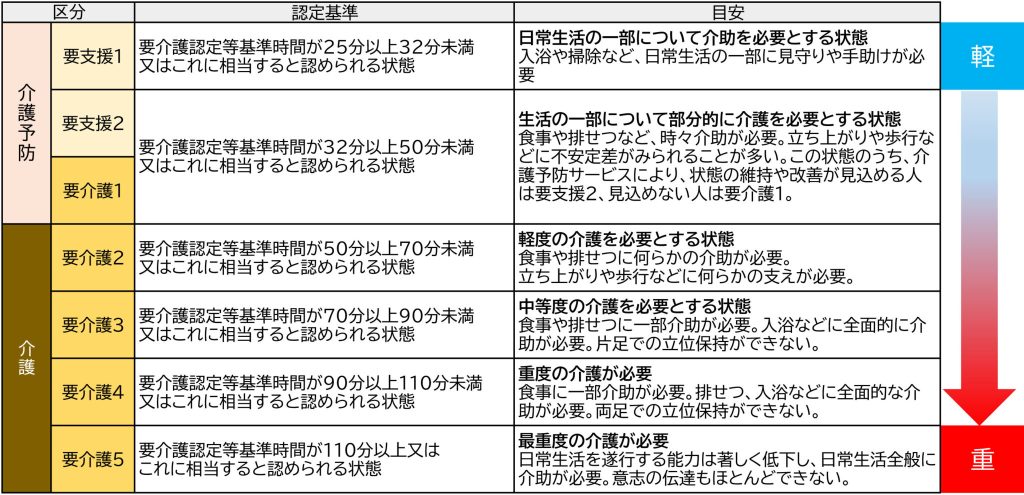

The nursing care certification is used to determine the degree of need for nursing care, and there are seven levels of certification: 1 to 2 for support, 1 to 5 for nursing care, and so on.

If you have applied for the certification for long-term care required but are not applicable, you cannot use long-term care insurance services (you are considered to be self-supporting).

Applications for certification for long-term care required is made at the municipal office, and after requesting the Regional Comprehensive Support Center to prepare a care plan if certified as requiring support 1-2, or a care manager if certified as requiring long-term care 1-5, the patient will be able to use long-term care services in accordance with the care plan.

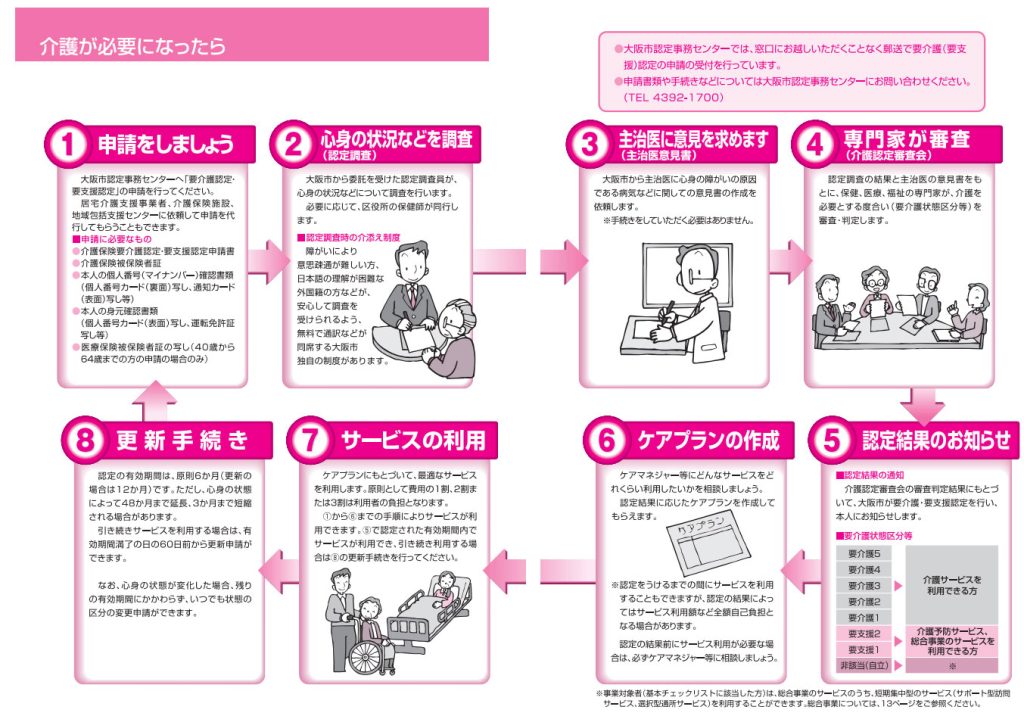

This excerpt from the Osaka City’s website summarizes everything from applying for long-term care to using services.

To review

(1) Apply to the Osaka City Certification Office Center for “Certification of Needs for Nursing Care and Support” *in the case of Osaka City.

What you need for the application

Application for Long-Term Care Insurance Certification of Long-Term Care Insurance Need for Nursing Care and Certification of Need for Assistance

Certificate of Long-Term Care Insurance Coverage

Documents confirming the person’s personal number (my number) *Copy of personal number card or notification card

Identification document of the person * Copy of personal number card (My number card) or copy of driver’s license

Copy of medical insurance card *In case of application by persons between 40 and 64 years old

(2) Investigation of physical and mental conditions, etc.

Surveyed by a certified surveyor or public health nurse

(3) Opinion of the attending physician

(4) Initial examination by computer → Examination by the Long-Term Care Certification Examination Board

In principle, it takes 30 days from the application to the notification of certification.

(6) Preparation of a care plan

(7) Use of services

After this, the patient is finally able to use the nursing care services.

In the next Blog, we will explain what kind of services are available.

For additional information or any questions please contact us here

Email: info@remax-apex.com