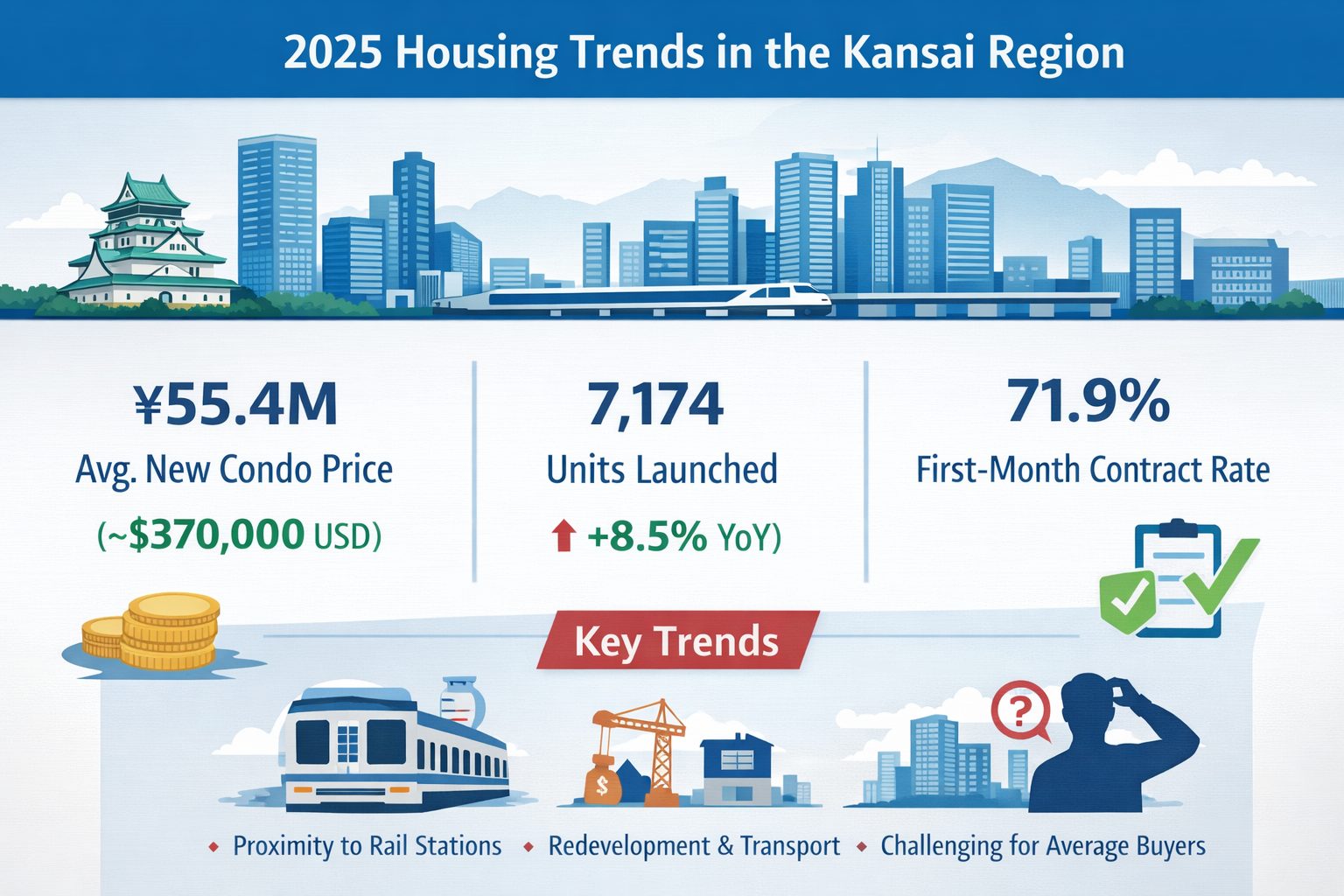

The new condominium market in 2025 exhibited wide regional disparities in momentum, yet one feature was common across all areas: prices did not decline, while buyers became increasingly selective. In the first half of fiscal 2025 (April–September), the Tokyo metropolitan area recorded an average price of ¥94.89 million, with 9,150 units launched (up 11.1% year on year) and a first-month contract rate of 61.9%. In the Kansai region, the average price was ¥55.43 million, with 7,174 units launched (up 8.5% year on year) and a first-month contract rate of 71.9%.

Although the Kansai market is smaller in absolute terms, supply relative to population exceeded that of the Tokyo metropolitan area. Even so, Kansai achieved a high first-month contract rate of 71.9%, compared with 61.9% in the Tokyo area. This suggests not that supply and demand are tighter in Kansai, but rather that pricing in the Tokyo metropolitan area has begun to exceed buyers’ acceptable thresholds. In both regions, the market has clearly shifted away from a situation in which “anything will sell” toward one in which buyers purchase only new condominiums that offer compelling justification.

The primary reason prices have been resistant to decline is the high cost of development. Elevated construction material prices and labor costs have not eased, and construction cost indices remained at historically high levels throughout 2025, continuing to post year-on-year increases. Even with efforts such as reducing unit sizes to contain headline prices, developers have little room to lower selling prices.

Another structural change has been the updating of regulatory standards. From April 2025, compliance with energy-efficiency standards became mandatory in principle for new buildings, including residential properties. While improved insulation and building systems enhance comfort and provide greater predictability in utility costs for buyers, the pass-through of these higher standards has also helped support prices.

Against this backdrop, centrally located properties offering combinations such as proximity to stations, attractive views or surroundings, and strong address branding continued to attract demand. In suburban areas, projects within a ten-minute walk of a station, large-scale developments, or those linked to redevelopment initiatives—where the preservation of future asset value is easy to envision—also performed well. By contrast, properties located far from stations, small-scale projects with inefficient management, or developments lacking redevelopment prospects saw muted demand. As prices have continued to rise, even properties once viewed as “affordable compared with the city center” have reached levels at which buyers can no longer make decisions based on price alone.

Similar trends are evident in Kyoto, where the author resides. Prices in central districts such as Tanoji and Goshominami have risen sharply. In the past, buyers unable to find suitable properties within their budgets in Kyoto City often turned to areas such as Kusatsu or Otsu in Shiga Prefecture, or Nagaokakyo City in Kyoto Prefecture. Today, however, even these areas have moved into price ranges that are difficult for first-time buyers to afford.

Another defining feature of 2025 has been a push toward greater transparency and market normalization. In the resale market, mandatory registration of the presence or absence of purchase applications in REINS was introduced in January 2025, helping to curb property hoarding and reduce unnecessary property viewings. Although these changes do not directly affect new condominium sales, they signal the beginning of broader market normalization. Industry groups and major developers have also been moving to establish rules to discourage short-term resales prior to handover, with several recent cases in which resale or leasing was restricted.

Some observers argue that housing prices will fall as vacant homes increase in what is often described as the “era of mass inheritance.” The author does not share this view. Properties that enter the market through inheritance tend to be older detached houses in suburban new towns or aging condominium units. Instead, demand is likely to rise for relatively new condominiums in central urban areas that deliver both high livability and convenience, driven by estate-planning needs and a preference for more comfortable housing. From this perspective, waiting for new condominium prices to fall does not appear to be a particularly realistic strategy.

For additional information or any questions please contact us here

Email: info@remax-apex.com