In real estate transactions, it is customary to pay a “deposit” (手付金) at the time of contract.

Protective measures for deposits, etc., are an important means of ensuring that buyers can proceed with the transaction with peace of mind. By understanding the basic role of the deposit and being aware of the protective measures, buyers can proceed with the transaction more confidently.

This article provides a detailed explanation of the protective measures for deposits, etc.

1. What is a deposit? Explanation of basic terms

What is a deposit in real estate transactions?

A deposit is the money paid by the buyer to the seller when signing a real estate sales contract, such as for land, a single-family home, or a condominium. It plays an important role in guaranteeing the establishment of the contract.

This money, paid from the buyer to the seller during the real estate sales contract, serves to demonstrate the establishment of the contract and the reliability of the agreement.

Difference between a deposit and a down payment

The deposit (手付金) and the down payment (頭金) are sometimes confused, but they have different meanings.

Deposit (手付金) = The money paid by the buyer when signing the sales contract

Down payment (頭金) = The amount of money, whether present or absent, varies from person to person

The deposit is a portion of the payment paid in advance at the time of the real estate sales contract.

Let’s look at two scenarios, assuming the purchase of a property worth 30 million yen:

Case 1:

Deposit: 3 million yen

Down payment: The deposit of 3 million yen

- At the time of the contract: The buyer pays 3 million yen as a deposit.

- At the time of settlement: The 3 million yen is applied as the down payment.

→ The remaining 27 million yen will be paid with a mortgage loan.

Case 2:

Deposit: 3 million yen

Down payment: The 3 million yen deposit plus an additional 2 million yen

- At the time of the contract: The buyer pays 3 million yen as a deposit.

- At the time of settlement: The 3 million yen deposit plus 2 million yen are applied as the down payment.

→ The remaining 25 million yen will be paid with a mortgage loan.

The down payment is the amount of money that can be prepared in cash in advance, and it is not included in the mortgage loan. The size of the down payment varies from person to person, and it is possible to purchase a property with a down payment of 0 yen if the buyer passes the mortgage loan screening.

2. The Role and Importance of the Deposit

The Three Roles of the Deposit

Deposits are used in various transactions, not just real estate. There are generally three types of deposits, each with its own role:

| Type of Deposit | Role / Meaning |

|---|---|

| Contract Deposit (証約手付) | A deposit that signifies the contract has been established and serves as proof of the agreement. |

| Cancellation Deposit (解約手付) | Deposit forfeited by the buyer when canceling the contract, effectively nullifying the agreement. (In cases of buyer-initiated cancellation, the deposit is generally not refunded.) |

| Double Return Deposit (手付倍返し) | If the seller cancels the contract, they must return twice the amount of the deposit to the buyer as compensation. |

| Breach of Contract Deposit (違約手付) | If the contract terms are violated, the deposit is forfeited as a penalty to the other party. |

The Role of the Deposit in Real Estate Transactions

In real estate transactions, immediate delivery of the property after the contract is signed is not possible. Therefore, the deposit serves as proof of the agreement and plays a key role in preventing either the seller or the buyer from easily canceling the contract.

In real estate sales, after the contract is concluded, there may be situations where the contract is canceled. If the contract is canceled, the deposit is used as compensation for damages or as a penalty, paid to the other party.

In real estate transactions, the deposit often serves the role of a “cancellation deposit” (解約手付). For the buyer to cancel the contract, they must forfeit the deposit. On the other hand, if the seller cancels the contract, they must pay the buyer double the amount of the deposit.

Market Rate for Deposits

The typical range for the deposit in real estate transactions is between 5% and 20% of the purchase price. The maximum amount is capped at 20% of the property price.

There is no legal minimum for the deposit amount. However, if the deposit is too small, it becomes easier for both the seller and the buyer to cancel the contract. Conversely, if the deposit is too large, it makes cancellation more difficult and defeats the purpose of the deposit as a cancellation penalty.

3. What are protective measures for deposits, etc.?

Now, let’s explain the protective measures for deposits, etc.

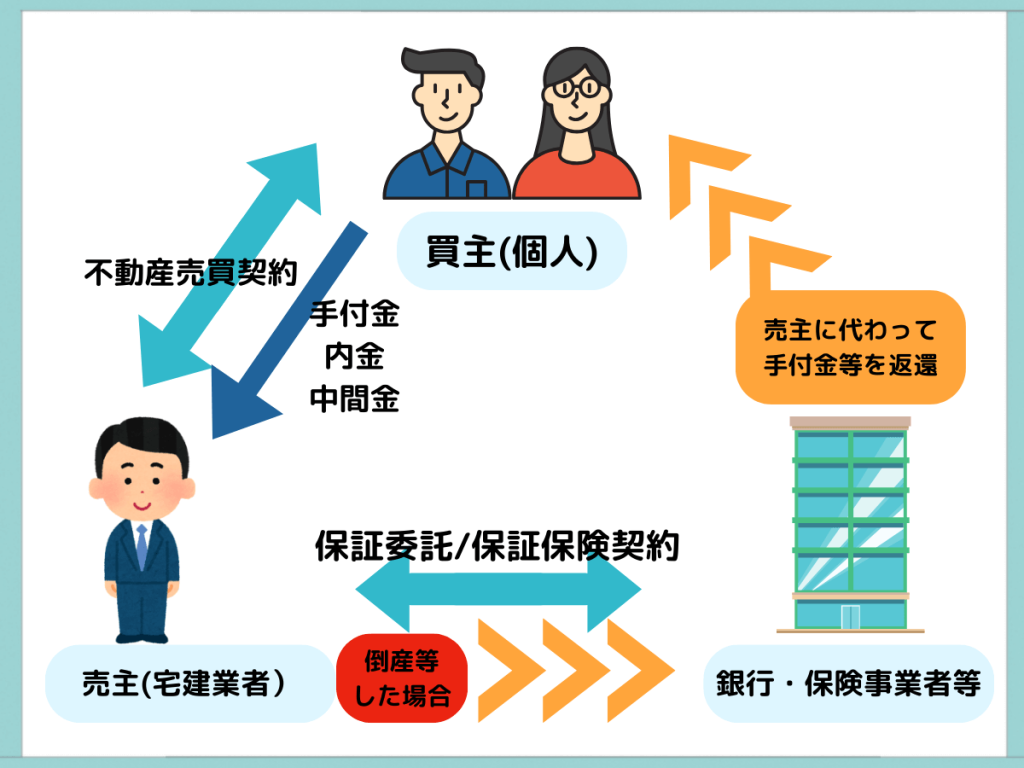

In real estate transactions, protective measures for deposits, such as “deposit,” “interim payment,” and “progress payment” made by the buyer to the seller before the property is delivered, typically involve having a third party hold these funds in escrow.

In the case of custom-built homes and similar transactions, it is common for the buyer to make payments in stages—such as the deposit, interim payments, and progress payments—before the property is delivered. These payments made by the buyer to the seller after the contract is signed and before the property is delivered are collectively referred to as “deposits, etc.” These funds are ultimately applied toward the final purchase price.

The “protective measures for deposits” refer to the safeguards in place to ensure that the buyer’s payments, such as the deposit, are returned in case of unforeseen circumstances, such as the seller going bankrupt before the property is completed and delivered.

Cases Where Deposits, etc., Should Not Be Accepted Without Implementing Protective Measures

- For unfinished properties: When receiving a deposit (or other payments) that exceeds 5% of the price or 10 million yen.

- For completed properties: When receiving a deposit (or other payments) that exceeds 10% of the price or 10 million yen.

For example:

Protective Measures for the Deposit on a Property Priced at 30 Million Yen:

If the deposit is above the following amounts, protective measures must be implemented:

- For unfinished property:

30 million yen × 5% = 1.5 million yen - For completed property:

30 million yen × 10% = 3 million yen

If the deposit is below these amounts, protective measures are not required.

Cases Where Protective Measures Are Not Needed:

- If the buyer has completed the registration of ownership transfer.

- If the transaction is between businesses (e.g., between real estate professionals).

Methods of Implementing Protective Measures for Deposits:

There are three methods for implementing protective measures for deposits, etc.:

- Guarantee Delegation Agreement: A joint guarantee agreement with a bank or similar institution.

- Guarantee Insurance Agreement: A guarantee agreement with an insurance company.

- Deposit Agreement and Pledge Agreement:

- This method is available for completed properties, but not for unfinished properties.

- Involves depositing funds with a designated escrow agency or similar institution.

1⃣ Guarantee Delegation Agreement with Banks, Trust Companies, etc.

This method involves having a bank or similar institution act as a joint guarantor.

Once the bank issues a written guarantee (a joint guarantee letter) to the buyer, confirming their role as a guarantor, the protective measures are considered in place.

In the event that the seller becomes liable for returning the deposit, the bank, as the joint guarantor, will cover the payment on the seller’s behalf.

2⃣ Guarantee Insurance Agreement with Insurance Companies

Under a guarantee insurance agreement, if the seller becomes liable for returning the deposit, the buyer can make a claim to the insurance company for payment.

This system allows the buyer to receive the deposit amount (or equivalent) as insurance compensation.

3⃣ Custody by a Designated Custody Agency

In this method, the seller deposits the deposit (or other prepayments) with a designated third-party custody agency, such as a credit guarantee corporation or a real estate transaction association.

If the seller becomes liable for returning the deposit, the custody agency will handle the return of the deposit to the buyer.

The Need and Purpose of Protective Measures for Deposits, etc.

The need and purpose of protective measures are to ensure the safe return of deposits paid by the buyer in the event of contract cancellation, and to protect the buyer’s rights.

These protective measures are mandatory only when the seller is a licensed real estate agent (宅建業者), and the buyer is an individual consumer, not a business.

Purpose of Protective Measures:

- To protect the buyer from unfair contracts and exploitation by malicious operators.

- To ensure that the buyer does not suffer a loss in the event of unforeseen circumstances.

Importance of Protective Measures for Deposits, etc., in Real Estate Transactions

Protective measures for deposits, etc., are a legal mechanism designed to safeguard the deposits and other advance payments made by the buyer. These measures guarantee that if a transaction is canceled after the sales contract is concluded, the buyer’s payments will be properly refunded.

In practice, this includes guarantees from insurance companies, banks, and other institutions. These measures allow the buyer to proceed with the transaction confidently, while the seller also gains credibility. In the event of issues or disputes, protective measures ensure a swift and fair resolution. As such, protective measures are vital for ensuring the safety and reliability of real estate transactions.

Specific Examples of Protective Measures for Deposits, etc.

Let’s look at some concrete cases where protective measures play an important role:

Q. The seller, a real estate company (licensed agent), has not implemented protective measures for the deposit, but the land and property sale contract is complete, and the deposit payment deadline is approaching.

A. If the seller (real estate agent) has not implemented protective measures and the buyer refuses to pay the deposit, the seller cannot pursue the buyer for breach of contract, cancel the contract, or demand penalties.

Therefore, if the seller has not taken protective measures, the buyer is not obligated to pay the deposit. The buyer should wait until protective measures are in place before making any payments.

This excludes cases where protective measures are not required.

Q. After the sales contract, the seller goes bankrupt. The house is not yet completed and there is no expected completion date. The buyer has already paid the deposit, and at the time of payment, the buyer received a joint guarantee letter from the seller’s bank.

A. The buyer should proceed with the steps to recover the deposit.

Since protective measures were in place, the deposit will be refunded by the bank that provided the guarantee.

4. Summary

In this article, we have covered the basic role of deposits and provided a detailed explanation of protective measures for deposits in real estate transactions. Understanding these fundamental concepts is crucial for conducting safer and more efficient real estate transactions. It’s important to have this knowledge to avoid potential disadvantages in the event of unforeseen circumstances.

For many of you reading this article, you might be actively looking for properties like condominiums or homes. While mortgage interest rates remain low, property prices, especially for condominiums, continue to rise. In addition to the price hikes, there are several other factors to consider, such as the potential for future interest rate increases, the impact of the 2024 issue leading to higher construction costs, and the effects of Japan’s declining population.

To avoid regrets when purchasing a property, it’s essential to stay well-informed and gather as much relevant information as possible. By carefully researching and understanding the market conditions and financial implications, you can make more confident decisions when it comes to purchasing real estate.

For additional information or any questions please contact us here

Email: info@remax-apex.com